- 193.50 KB

- 2022-08-09 发布

- 1、本文档由用户上传,淘文库整理发布,可阅读全部内容。

- 2、本文档内容版权归属内容提供方,所产生的收益全部归内容提供方所有。如果您对本文有版权争议,请立即联系网站客服。

- 3、本文档由用户上传,本站不保证质量和数量令人满意,可能有诸多瑕疵,付费之前,请仔细阅读内容确认后进行付费下载。

- 网站客服QQ:403074932

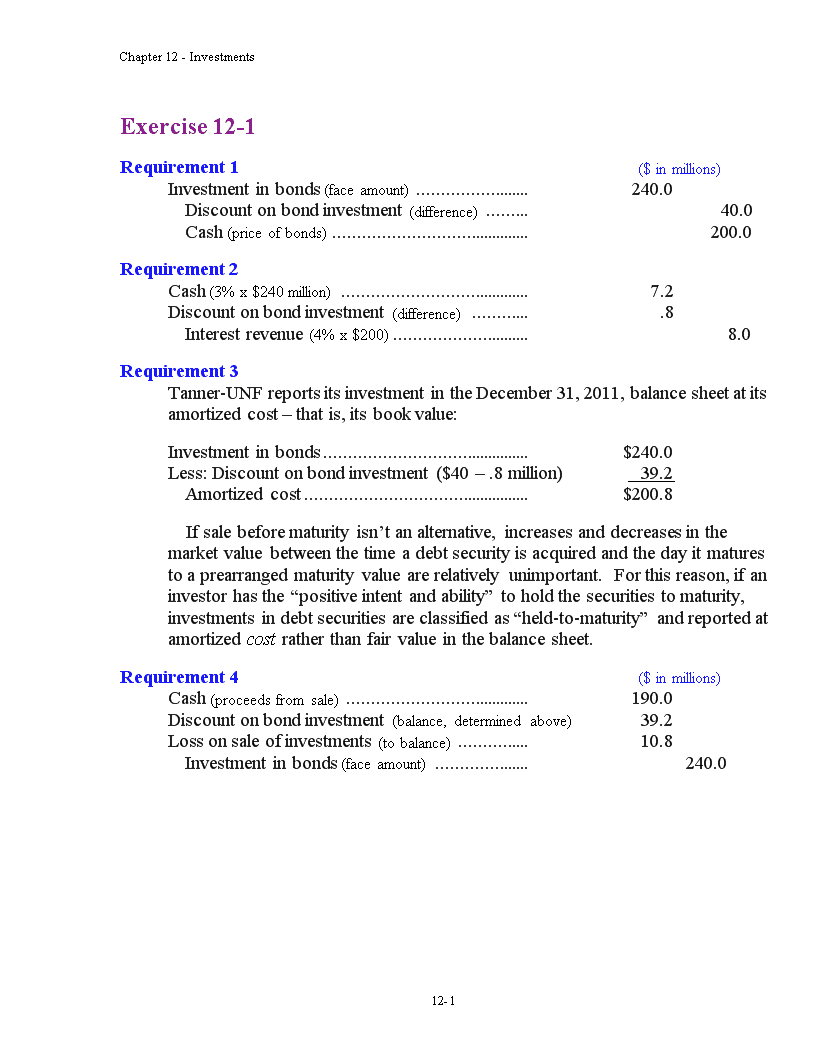

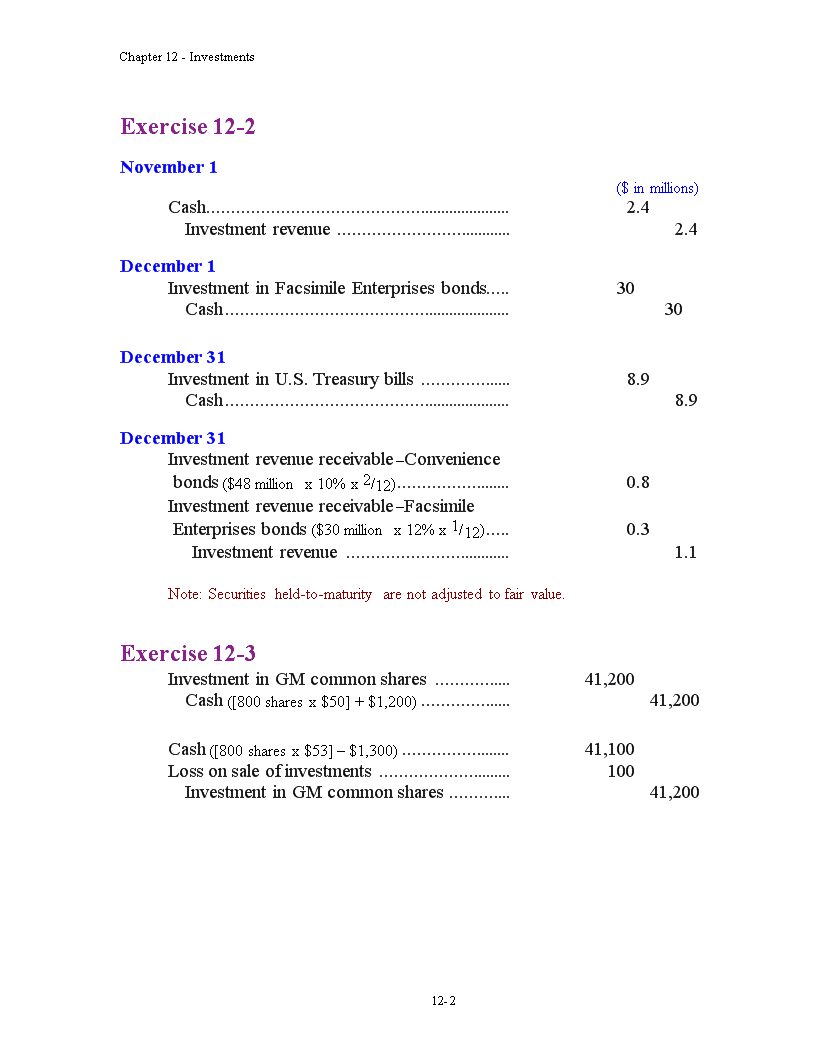

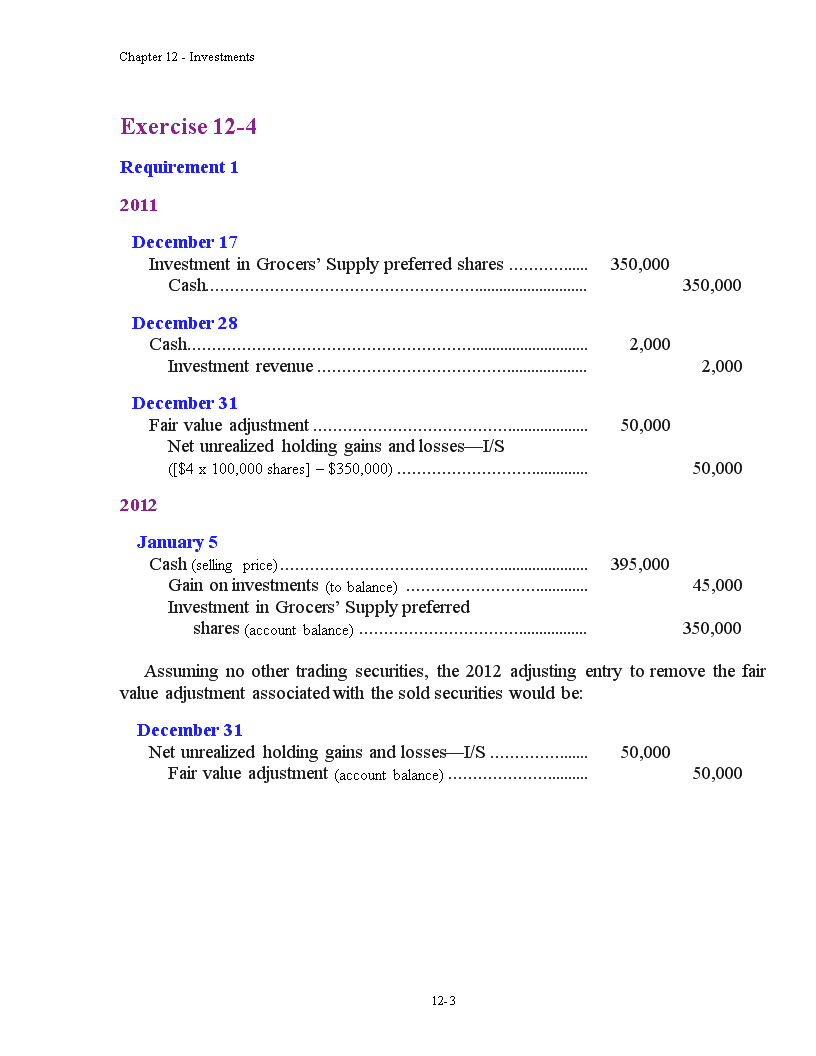

Chapter12-InvestmentsExercise12-1Requirement1($inmillions)Investmentinbonds(faceamount)240.0Discountonbondinvestment(difference)40.0Cash(priceofbonds)200.0Requirement2Cash(3%x$240million)7.2Discountonbondinvestment(difference).8Interestrevenue(4%x$200)8.0Requirement3Tanner-UNFreportsitsinvestmentintheDecember31,2011,balancesheetatitsamortizedcost–thatis,itsbookvalue:Investmentinbonds$240.0Less:Discountonbondinvestment($40–.8million)39.2Amortizedcost$200.8Ifsalebeforematurityisn’tanalternative,increasesanddecreasesinthemarketvaluebetweenthetimeadebtsecurityisacquiredandthedayitmaturestoaprearrangedmaturityvaluearerelativelyunimportant.Forthisreason,ifaninvestorhasthe“positiveintentandability”toholdthesecuritiestomaturity,investmentsindebtsecuritiesareclassifiedas“held-to-maturity”andreportedatamortizedcostratherthanfairvalueinthebalancesheet.Requirement4($inmillions)Cash(proceedsfromsale)190.0Discountonbondinvestment(balance,determinedabove)39.2Lossonsaleofinvestments(tobalance)10.8Investmentinbonds(faceamount)240.012-40\nChapter12-InvestmentsExercise12-2November1($inmillions)Cash2.4Investmentrevenue2.4December1InvestmentinFacsimileEnterprisesbonds30Cash30December31InvestmentinU.S.Treasurybills8.9Cash8.9December31Investmentrevenuereceivable–Conveniencebonds($48millionx10%x2/12)0.8Investmentrevenuereceivable–FacsimileEnterprisesbonds($30millionx12%x1/12)0.3Investmentrevenue1.1Note:Securitiesheld-to-maturityarenotadjustedtofairvalue.Exercise12-3InvestmentinGMcommonshares41,200Cash([800sharesx$50]+$1,200)41,200Cash([800sharesx$53]–$1,300)41,100Lossonsaleofinvestments100InvestmentinGMcommonshares41,20012-40\nChapter12-InvestmentsExercise12-4Requirement12011December17InvestmentinGrocers’Supplypreferredshares350,000Cash350,000December28Cash2,000Investmentrevenue2,000December31Fairvalueadjustment50,000Netunrealizedholdinggainsandlosses—I/S([$4x100,000shares]–$350,000)50,0002012January5Cash(sellingprice)395,000Gainoninvestments(tobalance)45,000InvestmentinGrocers’Supplypreferredshares(accountbalance)350,000Assumingnoothertradingsecurities,the2012adjustingentrytoremovethefairvalueadjustmentassociatedwiththesoldsecuritieswouldbe:December31Netunrealizedholdinggainsandlosses—I/S50,000Fairvalueadjustment(accountbalance)50,00012-40\nChapter12-InvestmentsExercise12-4(concluded)Requirement2BalanceSheet(short-terminvestment):Tradingsecurities$400,000IncomeStatement:Investmentrevenue(dividends)$2,000Netunrealizedholdinggainsandlosses(fromadjustingentry)50,000Note:Unlikeforsecuritiesavailable-for-sale,unrealizedholdinggainsandlossesfortradingsecuritiesareincludedinincome.12-40\nChapter12-InvestmentsExercise12-5Requirement1.Netunrealizedholdinggainsandlosses–OCI25,000Fairvalueadjustment($45,000–20,000)25,000Requirement2None.Accumulatednetholdinggainsandlossesforsecuritiesavailable-for-salearereportedasacomponentofshareholders’equity(inaccumulatedothercomprehensiveincome),andchangesinthebalancearereportedasothercomprehensiveincomeorlossinthestatementofcomprehensiveincomeratherthanaspartofearnings.Thisstatementcanbereportedeither(a)asanextensionoftheincomestatement,(b)aspartofthestatementofshareholders’equity,or(c)asaseparatestatementinadisclosurenote.12-40\nChapter12-InvestmentsExercise12-6Requirement1Securities“held-to-maturity”aredebtsecuritiesthataninvestorhasthe“positiveintentandability”toholdtomaturity.Activelytradedinvestmentsindebtorequitysecuritiesacquiredprincipallyforthepurposeofsellingthemintheneartermareclassifiedas“tradingsecurities.”TheIBMsharesareneither.Theyareclassifiedas“available-for-sale”sinceallinvestmentsindebtandequitysecuritiesthatdon’tfitthedefinitionsoftheotherreportingcategoriesareclassifiedthisway.Ofcourse,theequitymethodisn’tappropriateeitherbecause10,000sharesofIBMcertainlydon’tconstitute“significantinfluence.”Investmentsinsecuritiesavailable-for-salearereportedatfairvalue,andholdinggainsorlossesarenotincludedinthedeterminationofincomefortheperiod.Instead,theyarereportedasothercomprehensiveincomeorlossinthestatementofcomprehensiveincome.Thisstatementcanbereportedeither(a)asanadditionalsectionoftheincomestatement,(b)aspartofthestatementofshareholders’equity,or(c)asaseparatestatementinadisclosurenote.Accumulatednetholdinggainsandlossesforsecuritiesavailable-for-salearereportedasaseparatecomponentofshareholders’equityinthebalancesheet.Requirement2December31,2011Netunrealizedholdinggainsandlosses–OCI(10,000sharesx[$58–60])20,000Fairvalueadjustment20,00012-40\nChapter12-InvestmentsExercise12-6(concluded)Requirement3December31,2012Accumulated($in000s)UnrealizedAvailable-for-SaleSecuritiesCostFairValueGain(Loss)IBMshares–Dec.31,2012$600$610$10Movingfromanegative$20(2011)toapositive$10(2012)requiresanincreaseof$30:FairValueAdjustmentBalanceneededinfairvalueadjustment$10Existingbalanceinfairvalueadjustment:($20)Increase(decrease)neededinfairvalueadjustment:$30---------------------------------------------------------200+10+30----------------------------->Fairvalueadjustment10,000sharesx[$61–58])30,000Netunrealizedholdinggainsandlosses–OCI(-$20less$10)30,00012-40\nChapter12-InvestmentsExercise12-7Requirement12011March2($inmillions)InvestmentinPlatinumGauges,Inc.shares31Cash31April12InvestmentinZenithbonds20Cash20July18Cash2Investmentrevenue2October15Cash1Investmentrevenue1October16Cash21InvestmentinZenithbonds20Gainonsaleofinvestments1November1InvestmentinLTDpreferredshares40Cash4012-40\nChapter12-InvestmentsExercise12-7(continued)December31Accumulated($inmillions)UnrealizedAvailable-for-SaleSecuritiesCostFairValueGain(Loss)PlatinumGauges,Inc.shares$31$32*$1LTDpreferredshares4037**(3)Totals$71$69$(2)*$32x1millionshares**$74x500,000sharesAdjustingentry:Netunrealizedholdinggainsandlosses–OCI($71–69)2Fairvalueadjustment($71–69)22012January23($inmillions)Cash([1millionsharesx1/2]x$32)16.0Gainonsaleofinvestments(difference)0.5InvestmentinPlatinumGaugesshares($31millioncostx1/2)15.5March1Cash($76x500,000shares)38Lossonsaleofinvestments(difference)2InvestmentinLTDpreferred(cost)40Note:Aspartoftheprocessofrecordingthenormal,period-endfairvalueadjustingentryat12/31/2012,ConstructionwoulddebitFairvalueadjustmentandcreditNetunrealizedgainsandlosses—OCIforthe$2.5millionassociatedwiththesoldinvestmentstoremovetheireffectsfromthefinancialstatements.(ConstructionsoldonlyhalfthePlatinuminvestmentssoonlyhalfofthePlatinumfairvalueadjustmentshouldberemoved.The2.5amountcomesfrom3.0LTD-0.5Platinum.)12-40\nChapter12-InvestmentsExercise12-7(concluded)Requirement22011IncomeStatement($inmillions)Investmentrevenue(fromJuly18;Oct.15)$3Gainonsaleofinvestments(fromOct.16)1Othercomprehensiveincome:*Netunrealizedholdinggainsandlossesoninvestments**$2**AssumingConstructionFormschoosestoreportOthercomprehensiveincomeasanadditionalsectionoftheincomestatement.Alternatively,itcanreportthis(a)aspartofthestatementofshareholders’equityor(b)asaseparatestatementinadisclosurenote.Note:Unlikefortradingsecurities,unrealizedholdinggainsandlossesarenotincludedinincomeforsecuritiesavailable-for-sale.Rather,theyareincludedinothercomprehensiveincome,andaccumulatedinshareholders’equityinaccumulatedothercomprehensiveincome.12-40\nChapter12-InvestmentsExercise12-8Requirement1Purchase($inmillions)InvestmentinJacksonIndustryshares90Cash90NetincomeNoentryDividendsCash(5%x$60million)3Investmentrevenue3AdjustingentryFairvalueadjustment($98–90million)8Netunrealizedholdinggainsandlosses–OCI8Requirement2Investmentrevenue$3millionNote:Anunrealizedholdinggainisnotincludedinincomeforsecuritiesavailable-for-sale.Rather,itisincludedinothercomprehensiveincome,andaccumulatedinshareholders’equityinaccumulatedothercomprehensiveincome.12-40\nChapter12-InvestmentsExercise12-91.Investmentsreportedascurrentassets.SecurityA$910,000SecurityB100,000SecurityC780,000SecurityE490,000Total$2,280,0002.Investmentsreportedasnoncurrentassets.SecurityD$915,000SecurityF615,000$1,530,0003.Unrealizedgain(orloss)componentofincomebeforetaxes.TradingSecurities:CostFairvalueUnrealizedgain(loss)SecurityA$900,000$910,000$10,000B105,000100,000(5,000)Totals$1,005,000$1,010,000$5,0004.Unrealizedgain(orloss)componentofAOCIinshareholders’equity.SecuritiesAvailable-for-Sale:CostFairvalueUnrealizedgain(loss)SecurityC$700,000$780,000$80,000D900,000915,00015,000Totals$1,600,000$1,695,000$95,00012-40\nChapter12-InvestmentsExercise12-10Requirement1Accumulated($in000s)UnrealizedAvailable-for-SaleSecuritiesCostFairValueGain(Loss)IBMshares–Dec.31,2011$1,345$1,175$(170)Movingfromanegative$145(Jan.1)toanegative$170requiresareductionof$25:FairValueAdjustmentBalanceneededinfairvalueadjustment($170)Existingbalanceinfairvalueadjustment:($145)Increase(decrease)neededinfairvalueadjustment:($25)---------------------------------------------------------170-1450<----------------–25Netunrealizedholdinggainsandlosses–OCI25,000Fairvalueadjustment($1,175,000–1,200,000)25,00012-40\nChapter12-InvestmentsExercise12-10(continued)Requirement2Accumulated($in000s)UnrealizedAvailable-for-SaleSecuritiesCostFairValueGain(Loss)IBMshares–Dec.31,2011$1,345$1,275$(70)Movingfromanegative$145(Jan.1)toanegative$70requiresanincreaseof$75:FairValueAdjustmentBalanceneededinfairvalueadjustment($70)Existingbalanceinfairvalueadjustment:($145)Increase(decrease)neededinfairvalueadjustment:$75--------------------------------------------------------------------------------------------145-700+75---------------------->Fairvalueadjustment($1,275,000–1,200,000)75,000Netunrealizedholdinggainsandlosses–OCI75,00012-40\nChapter12-InvestmentsExercise12-10(concluded)Requirement3Accumulated($in000s)UnrealizedAvailable-for-SaleSecuritiesCostFairValueGain(Loss)IBMshares–Dec.31,2011$1,345$1,375$30Movingfromanegative$145(Jan.1)toapositive$30requiresanincreaseof$175:FairValueAdjustmentBalanceneededinfairvalueadjustment$30Existingbalanceinfairvalueadjustment:($145)Increase(decrease)neededinfairvalueadjustment:$175--------------------------------------------------------------------------------------------145-700+30+175-------------------------------------------------------->Fairvalueadjustment($1,375,000–1,200,000)175,000Netunrealizedholdinggainsandlosses–OCI175,00012-40\nChapter12-InvestmentsExercise12-11Requirement1ThesaleoftheACorporationsharesdecreasedHarlon’spretaxearningsby$5million.ThepurchaseoftheCCorporationshareshadnoeffectonHarlon’s2012earnings(becausethesharesareclassifiedasavailable-for-saleinvestments,anyunrealizedgainsorlossesoccurringafterpurchaseduring2012wouldnotaffect2012earnings).Herearetheentriesusedtorecordthosetwotransactions:June1,2012($inmillions)Cash15Lossonsaleofinvestments(difference)5InvestmentinACorporationshares(cost)20September12,2012InvestmentinCCorporationshares15Cash1512-40\nChapter12-InvestmentsExercise12-11(concluded)Requirement2Harlon’ssecuritiesavailable-for-saleportfolioshouldbereportedinits2012balancesheetatitsfairvalueof$101million:December31,2012($inmillions)Cost,Dec.31FairValue,Dec.31SecuritiesAvailable-for-Sale2011201220112012ACorporationshares$20na$14naBCorporationbonds35$3535$37CCorporationsharesna15na14DIndustriesshares45454650Totals$100$95$95$101In2011,Harlonwouldhavehadanetunrealizedlossof$5(costof$100–fairvalueof$95).Movingfromanegative$5(2011)toapositive$6requiresanincreaseof$11:FairValueAdjustmentAllowanceBalanceneededinfairvalueadjustment$6Existingbalanceinfairvalueadjustment:(5)Increase(decrease)neededinfairvalueadjustment:$11----------------------------------------------------------50+6+11----------------------------->Fairvalueadjustment($5creditto$6debit)11Netunrealizedholdinggainsandlosses–OCI11Theadjustmenthasnoeffectonearnings.Unlikefortradingsecurities,unrealizedholdinggainsandlossesarenotincludedinincomeforsecuritiesavailable-for-sale.Rather,theyareincludedinothercomprehensiveincome,andaccumulatedinshareholders’equityinaccumulatedothercomprehensiveincome.12-40\nChapter12-InvestmentsExercise12-12Requirement1Theinvestmentwouldbeaccountedforasanavailable-for-saleinvestment:PurchaseInvestmentinAMCcommonshares480,000Cash480,000NetincomeNoentryDividendsCash(20%x400,000sharesx$0.25)20,000Investmentrevenue20,000AdjustingentryFairvalueadjustment($505,000–480,000)25,000Netunrealizedholdinggainsandlosses–OCI25,000Requirement2Theinvestmentwouldbeaccountedforusingtheequitymethod:PurchaseInvestmentinAMCcommonshares480,000Cash480,000NetincomeInvestmentinAMCcommonshares(20%x$250,000)50,000Investmentrevenue50,000DividendsCash(20%x400,000sharesx$0.25)20,000InvestmentinAMCcommonshares20,000AdjustingentryNoentry12-40\nChapter12-InvestmentsExercise12-13Purchase($inmillions)InvestmentinNurserySuppliesshares56Cash56NetincomeInvestmentinNurserySuppliesshares(30%x$40million)12Investmentrevenue12DividendsCash(30%x8millionsharesx$1.25)3InvestmentinNurserySuppliesshares3AdjustingentryNoentryExercise12-14Requirement1($inmillions)Investmentinequitysecurities($48million–31million)17Retainedearnings(investmentrevenuefromtheequitymethod)17Requirement2Financialstatementswouldberecasttoreflecttheequitymethodforeachyearreportedforcomparativepurposes.Adisclosurenotealsoshoulddescribethechange,justifytheswitch,andindicateitseffectsonallfinancialstatementitems.Requirement3Whenacompanychangesfromtheequitymethod,noadjustmentismadetothecarryingamountoftheinvestment.Instead,theequitymethodissimplydiscontinued,andthenewmethodisappliedfromthenon.Thebalanceintheinvestmentaccountwhentheequitymethodisdiscontinuedwouldserveasthenew“cost”basisforwritingtheinvestmentupordowntofairvalueinthenextsetoffinancialstatements.Therealsowouldbenorevisionofprioryears,butthechangeshouldbedescribedinadisclosurenote.12-40\nChapter12-InvestmentsExercise12-15Requirement1:Errordiscoveredbeforethebooksareadjustedorclosedin2011.Thejournalentrythecompanymadeis:Cash100,000Investments100,000Thejournalentrythecompanyshouldhavemadeis:Cash100,000Investments80,000Gainonsaleofinvestments($100,000–80,000)20,000Therefore,togetfromwhatwasdonetowhatshouldhavebeendone,thefollowingentryisneeded:Investments($100,000–80,000)20,000Gainonsaleofinvestments20,000Requirement2:Errornotdiscovereduntilearly2012.Investments($100,000–80,000)20,000Retainedearnings20,00012-40\nChapter12-InvestmentsExercise12-16Purchase($inmillions)InvestmentinCarneCosmeticsshares68Cash68NetincomeInvestmentinCarneCosmeticsshares(25%x$40million)10Investmentrevenue10DividendsCash(4millionsharesx$1)4InvestmentinCarneCosmeticsshares4DepreciationAdjustmentInvestmentrevenue($8million[calculationbelow‡]÷8years)1InvestmentinCarneCosmeticsshares1‡Calculations:InvesteeNetAssetsDifferenceNetAssetsPurchasedAttributedto:ßßßCost$68ýGoodwill:$12Fairvalue:$224*x25%=$56ýUndervaluationBookvalue:$192x25%=$48ofassets:$8*[$192+32]=$224AdjustingentryNoentrytoadjustforchangesinfairvalueasthisinvestmentisaccountedforundertheequitymethod.12-40\nChapter12-InvestmentsExercise12-17Requirement1Purchase($inmillions)InvestmentinLakeConstructionshares300Cash300NetincomeInvestmentinLakeConstructionshares(20%x$150million)30Investmentrevenue30DividendsCash(20%x$30million)6InvestmentinLakeConstructionshares6AdjustmentfordepreciationInvestmentrevenue($10million[calculationbelow‡]÷10years)1InvestmentinLakeConstructionshares1‡calculation:InvesteeNetAssetsDifferenceNetAssetsPurchasedAttributedto:ßßßCost$300ýGoodwill:$120Fairvalue:$900x20%=$180ýUndervaluationBookvalue:$800x20%=$160ofbuildings($10)andland($10):$20Requirement2a.InvestmentinLakeConstructionshares($inmillions)Cost300Shareofincome306Dividends1Depreciationadjustment_________________Balance32312-40\nChapter12-InvestmentsExercise12-17(concluded)b.Asinvestmentrevenueintheincomestatement.$30million(shareofincome)–$1million(depreciationadjustment)=$29millionc.Amonginvestingactivitiesinthestatementofcashflows.$300million[Cashdividendsreceived($6million)alsoarereported-aspartofoperatingactivities.IfCameronreportscashflowsusingtheindirectmethod,theoperationssectionofitsstatementofcashflowswouldincludeanadjustmentof($23million)togetfromthenetincomefigurethatincludes$29millionofrevenuetoacashflownumberthatshouldonlyinclude$6millionofcashflow.]12-40\nChapter12-InvestmentsExercise12-18Requirement1Firstweneedtoidentifytheamountofdifferencebetweenbookvalueandfairvalueassociatedwithgoodwill,buildingsandland:InvesteeNetAssetsDifferenceNetAssetsPurchasedAttributedto:ßßßCost$750ýGoodwill:$300Fairvalue:$900x50%=$450ýUndervaluationBookvalue:$800x50%=$400ofbuildings($25)andland($25):$50a.January1,2011effectonBuildingsBecausehalfofthefairvalueofLake’sindividualnetassetsarebuildings,andLakewouldbeconsolidatedwithCameron,Cameron’sBuildingsaccountwouldincreaseby1/2x$450=$225million.b.January1,2011effectonLandBecausehalfofthefairvalueofLake’sindividualnetassetsisland,andLakewouldbeconsolidatedwithCameron,Cameron’sLandaccountwouldincreaseby1/2x$450=$225million.c.January1,2011effectonGoodwillBecauseLakewouldbeconsolidatedwithCameron,Cameron’sGoodwillaccountwouldincreaseby$300million.d.January1,2011effectonEquitymethodinvestmentsBecauseLakewouldbeconsolidatedwithCameron,therewouldbenoeffectofthisinvestmentonCameron’sEquitymethodinvestmentaccount.12-40\nChapter12-InvestmentsExercise12-18(concluded)Requirement2a.December31,2011effectonBuildingsBecausehalfofthefairvalueofLake’sindividualnetassetsarebuildings,andLakewouldbeconsolidatedwithCameron,Cameron’sBuildingsaccountwouldincreaseby1/2x$450=$225million.Cameronwoulddepreciatethosebuildingsovertheirremaining10yearlife,soLakewouldrecognize$22.5millionofdepreciationexpenseperyear($225million÷10years).Therefore,atDecember31,2011,thebuildingsassociatedwiththeLakeinvestmentwouldhaveacarryingvalueof$202.5million($225millioncost-$22.5millionaccumulateddepreciation).b.December31,2011effectonLandLandisnotamortized,soitscarryingvaluewouldnotchangefromitsvalueonJanuary1,2011.c.December31,2011effectonGoodwillGoodwillisnotamortized,soitscarryingvaluewouldnotchangefromitsvalueonJanuary1,2011.d.December31,2011effectonEquitymethodinvestmentsBecauseLakewouldbeconsolidatedwithCameron,therewouldbenoeffectofthisinvestmentonCameron’sEquitymethodinvestmentaccountatDecember31,2011.Requirement3TheeffectoftheinvestmentonCameron’sDecember31,2011retainedearningswouldnotdifferbetweentheequitymethodandproportionateconsolidationtreatments.Undertheequitymethod,CameronwouldrecognizeinvestmentrevenuebasedonitsshareofLake’snetincome,whileunderproportionateconsolidation,CameronwouldincludeitsshareofLake’srevenueandexpensesonthoselinesoftheconsolidatedincomestatement.Regardless,thesametotalamountwouldbeincludedinCameron’snetincomeandclosedtoCameron’sretainedearnings.12-40\nChapter12-InvestmentsExercise12-19Requirement1Electingthefairvalueoptionforheld-to-maturitysecuritiessimplyrequiresreclassifyingthosesecuritiesastradingsecurities.Therefore,thisinvestmentwouldbeclassifiedasatradingsecurityonTanner-UNF’sbalancesheet.Requirement2($inmillions)Investmentinbonds(faceamount)240Discountonbondinvestment(difference)40Cash(priceofbonds)200Requirement3Cash(3%x$240million)7.2Discountonbondinvestment(difference).8Interestrevenue(4%x$200)8.0Requirement4Thecarryingvalueofthebondsis$240–($40–$0.8)=$200.8.Therefore,toadjusttofairvalueof$210,Tanner-UNFwouldneedthefollowingjournalentry:Fairvalueadjustment9.2Netunrealizedholdinggainsandlosses—I/S($210–200.8)9.2Requirement5Tanner-UNFreportsitsinvestmentintheDecember31,2011,balancesheetatfairvalueof$210million.Requirement6($inmillions)Cash(proceedsfromsale)190.0Lossonsaleofinvestments(tobalance)10.8Discountonbondinvestment(accountbalance)39.2Investmentinbonds(accountbalance)240.0Assumingnoothertradingsecurities,the2012adjustingentrywouldbe:Netunrealizedholdinggainsandlosses—I/S9.2Fairvalueadjustment(accountbalance)9.212-40\nChapter12-InvestmentsExercise12-20Requirement1Electingthefairvalueoptionforavailable-for-salesecuritiessimplyrequiresreclassifyingthosesecuritiesastradingsecurities.Therefore,thisinvestmentwouldbeclassifiedasatradingsecurityonSanborn’sbalancesheet.Requirement2Purchase($inmillions)InvestmentinJacksonIndustryshares90Cash90NetincomeNoentryDividendsCash(5%x$60million)3Investmentrevenue3AdjustingentryFairvalueadjustment($98–90million)8Netunrealizedholdinggainsandlosses—I/S8Requirement3Investmentrevenue(dividends)$3,000Netunrealizedholdinggainsandlosses(fromadjustingentry)8,000Totaleffecton2011netincomebeforetaxes11,00012-40\nChapter12-InvestmentsExercise12-21Requirement1Electingthefairvalueoptionforsignificant-influenceinvestmentsrequiresuseofthesamebasicaccountingapproachthatisusedfortradingsecurities.However,theinvestmentswillstillbeclassifiedassignificant-influenceinvestmentsandshowneitheronthesamelineofthebalancesheetasequity-methodinvestments(butwiththeamountatfairvalueindicatedparenthetically)oronaseparatelineofthebalancesheet.Requirement2Purchase($inmillions)InvestmentinNurserySuppliesshares56Cash56NetincomeNoentry.DividendsCash(30%x8millionsharesx$1.25)3Investmentrevenue3AdjustingentryNetunrealizedholdinggainsandlosses—I/S($56–52million)4Fairvalueadjustment412-40\nChapter12-InvestmentsNote:AdifferentapproachtoreachthesameoutcomewouldbeforFloriststouseequity-methodaccountingthroughouttheyear,andthenattheendoftheyearmakewhateveradjustmenttofairvalueisnecessarytoadjusttheinvestmentaccounttofairvalue.Underthatapproach,Floristswouldrecognize30%ofNursery’s$40millionofincome($12million)asinvestmentincome,itwouldnotrecognizeinvestmentincomeassociatedwithNursery’sdividend,andwouldendupwithanInvestmentaccountcontaining$65($56million+$12million–$3million).Thecompanywouldneedtomakeafairvalueadjustmentof$13million($65million–52million).Sothetotalamountoflossrecognizedwouldbe$1million($12millioninvestmentincome–$13millionunrealizedloss).Notethatthisalternativeproducesthesametotalamountofinvestmentlossasisproducedabove:$1million($3millioninvestmentrevenue–$4millionunrealizedloss).Exercise12-22Requirement1Insuranceexpense(difference)64,000Cashsurrendervalueoflifeinsurance($27,000–21,000)6,000Cash(2011premium)70,000Requirement2Cash(deathbenefit)4,000,000Cashsurrendervalueoflifeinsurance(accountbalance)27,000Gainonlifeinsurancesettlement(tobalance)3,973,000Exercise12-23Requirement1Insuranceexpense(difference)22,900Cashsurrendervalueoflifeinsurance($4,600–2,500)2,100Cash(premium)25,000Requirement2Cash(deathbenefit)250,000Cashsurrendervalueoflifeinsurance(accountbalance)16,000Gainonlifeinsurancesettlement(tobalance)234,00012-40\nChapter12-InvestmentsExercise12-24Requirement1Bloombelievesitismorelikelythannotitwillhavetoselltheinvestmentbeforefairvaluerecovers,sotheportionoftheimpairmentthatconsistsofcreditandnon-creditlossesisnotrelevant.BloommustrecognizetheentireOTTimpairmentinearningsasfollows:Other-than-temporaryimpairmentloss–I/S400,000Discountonbondinvestment400,000Ontheincomestatement,theentire$400,000willbeshownasanOTTimpairmentloss.Requirement2Bloomdoesnotplantoselltheinvestment,anddoesnotbelieveitismorelikelythannotthatitwillhavetoselltheinvestmentbeforefairvaluerecovers,sotheportionoftheimpairmentthatconsistsofcreditandnon-creditlossesisrelevant.Bloommustrecognizethe$250,000ofcreditlossesasanOTTimpairmentinearnings,andtheother$150,000asareductionofOCI,asfollows:Other-than-temporaryimpairmentloss–I/S250,000Discountonbondinvestment250,000OTTimpairmentloss–OCI150,000Fairvalueadjustment–Non-creditloss150,000Ontheincomestatement,theentire$400,000willbeshownasanOTTimpairmentloss,thentheamountofnon-creditlossissubtractedtoleaveonlythecreditlossreducingearnings:OTTimpairmentonHTMinvestmentsTotalOTTimpairmentloss($400,000)LessportionrecognizedinOCI$150,000NetOTTimpairmentrecognizedinearnings($250,000)12-40\nChapter12-InvestmentsExercise12-24(concluded)Requirement3Bloomdoesnotplantoselltheinvestment,anddoesnotbelieveitismorelikelythannotthatBloomwillhavetoselltheinvestmentbeforefairvaluerecovers,buttheentireimpairmentconsistsofnon-creditlosses,soBloomdoesnotrecordanyOTTimpairment.12-40\nChapter12-InvestmentsExercise12-25Requirement1:AssumingBloomhasnotpreviouslyrecordeda$100,000lossScenario1:Bloombelievesitismorelikelythannotitwillhavetoselltheinvestmentbeforefairvaluerecovers,sotheportionoftheimpairmentthatconsistsofcreditandnon-creditlossesisnotrelevant.BloommustrecognizetheentireOTTimpairmentinearnings.Bloommakesthefollowingentry:Other-than-temporaryimpairmentloss–I/S400,000Discountonbondinvestment400,000Ontheincomestatement,theentire$400,000willbeshownasanOTTimpairmentloss.ThereisnoeffectonOCI,anda$400,000effectoncomprehensiveincome.Scenario2:Bloomdoesnotplantoselltheinvestment,anddoesnotbelieveitismorelikelythannotthatitwillhavetoselltheinvestmentbeforefairvaluerecovers,sotheportionoftheimpairmentthatconsistsofcreditandnon-creditlossesisrelevant.Bloommustrecognizethe$250,000ofcreditlossesasanOTTimpairmentinearnings,andtheother$150,000asareductionofOCI.Bloommakesthefollowingentry:Other-than-temporaryimpairmentloss–I/S250,000Discountonbondinvestment250,000Netunrealizedholdinggainsandlosses—OCI150,000Fairvalueadjustment150,000Ontheincomestatement,theentire$400,000willbeshownasanOTTimpairmentloss,thentheamountofnon-creditlossissubtractedtoleaveonlythecreditlossreducingearnings:OTTimpairmentonAFSinvestmentsTotalOTTimpairmentloss($400,000)LessportionrecognizedinOCI$150,000NetOTTimpairmentrecognizedinearnings($250,000)So,netincomewillbedecreasedby$250,000,OCIby$150,000,andcomprehensiveincomeby$400,000.12-40\nChapter12-InvestmentsExercise12-25(continued)Scenario3:Bloomdoesnotplantoselltheinvestment,anddoesnotbelieveitismorelikelythannotthatitwillhavetoselltheinvestmentbeforefairvaluerecovers,buttheentireimpairmentconsistsofnon-creditlosses,soBloomdoesnotrecordanyOTTimpairment.Requirement2:AssumingBloomhaspreviouslyrecordeda$100,000lossScenario1:Bloombelievesitismorelikelythannotitwillhavetoselltheinvestmentbeforefairvaluerecovers,sotheportionoftheimpairmentthatconsistsofcreditandnon-creditlossesisnotrelevant.BloommustrecognizetheentireOTTimpairmentinearnings.Bloommakesthefollowingentry:Other-than-temporaryimpairmentloss–I/S400,000Discountonbondinvestment400,000Assumingapreviouslyrecorded$100,000unrealizedloss,BloommustalsoreclassifythatlossoutofOCIandthefairvalueadjustment.In2010Bloomwouldhavemadethefollowingentry:Netunrealizedholdinggainsandlosses—OCI100,000Fairvalueadjustment100,000Sotoreclassifythatunrealizedloss,Bloomwouldreversethatentry.Fairvalueadjustment100,000Netunrealizedholdinggainsandlosses—OCI100,000Ontheincomestatement,theentire$400,000willbeshownasanOTTimpairmentloss.OCIwillbeincreasedbythe$100,000reclassification,suchthattheneteffectoncomprehensiveincomeis$300,000.12-40\nChapter12-InvestmentsExercise12-25(concluded)Scenario2:Bloomdoesnotplantoselltheinvestment,anddoesnotbelieveitismorelikelythannotthatitwillhavetoselltheinvestmentbeforefairvaluerecovers,sotheportionoftheimpairmentthatconsistsofcreditandnon-creditlossesisrelevant.Bloommustrecognizethe$250,000ofcreditlossesasanOTTimpairmentinearnings,andtheother$150,000asareductionofOCI.Bloommakesthefollowingentry:Other-than-temporaryimpairmentloss250,000Discountonbondinvestment250,000Netunrealizedholdinggainsandlosses—OCI150,000Fairvalueadjustment150,000Assumingapreviouslyrecorded$100,000unrealizedloss,BloommustalsoreclassifythatlossoutofOCIandthefairvalueadjustment:Fairvalueadjustment100,000Netunrealizedholdinggainsandlosses--OCI100,000Notethat,whencombinedwiththeotherjournalentries,theneteffectisthatnetincomeisdecreasedby$250,000,OCIisdecreasedby$50,000($150,000–100,000),andcomprehensiveincomethereforeisdecreasedby$300,000.Thatmakessense,because$100,000ofdecreaseinOCIandcomprehensiveincomeoccurredin2010,whenthe$100,000unrealizedlosswasrecognized.Scenario3:Bloomdoesnotplantoselltheinvestment,anddoesnotbelieveitismorelikelythannotthatitwillhavetoselltheinvestmentbeforefairvaluerecovers,buttheentireimpairmentconsistsofnon-creditlosses,soBloomdoesnotrecordanyOTTimpairment.12-40\nChapter12-InvestmentsExercise12-26December31,2011:Kettlemustrecordanunrealizedlossof$10,000toaccountforthefactthatthefairvalueofIcalc’sshareshasfallenfromtheoriginalcostof$50,000to$40,000.Netunrealizedholdinggainsandlosses–OCI10,000Fairvalueadjustment($50,000–40,000)10,000Thisadjustmenthasnoeffectonnetincome,butitreducesOCIandcomprehensiveincomeby$10,000.December31,2012:KettlenowmustrecordanOTTimpairment.Toreducetheinvestmentfromitsoriginalcostof$50,000to$25,000,Kettlemakesthefollowingentry:Other-than-temporaryimpairmentloss($50,000–25,000)25,000InvestmentinIcalc25,000Kettlealsomustreclassifythe2011unrealizedlossoutofOCIandremovethefairvalueadjustment,makingthefollowingentrythatreversesthe2011entry:Fairvalueadjustment10,000Netunrealizedholdinggainsandlosses—OCI10,000Ontheincomestatement,the$25,000willbeshownasanOTTimpairmentloss.OCIwillbeincreasedbythe$10,000reclassification,suchthattheneteffectoncomprehensiveincomeis$15,000.December31,2013:SubsequenttorecordingtheOTTimpairment,KettlecontinuestotreattheinvestmentasAFS,butwithanamortizedcostof$25,000.Givenanincreaseinfairvalueto$30,000during2013,Kettlerecordsa$5,000unrealizedgain,withnoeffectonnetincomebutanincreaseof$5,000toOCIandcomprehensiveincome:Fairvalueadjustment5,000Netunrealizedholdinggainsandlosses—OCI5,00012-40\nChapter12-InvestmentsExercise12-27Requirement1HTMinvestment,December31,2011UnderIFRS,onlycreditlossesarerecognizedasOTTimpairmentswithrespecttoHTMinvestments.Therefore,Flowerwouldmakethefollowingjournalentrytoreducethecarryingvalueoftheinvestmentfromitsamortizedcostof€1,000,000tothepresentvalueofexpectedfuturecashflows(computedatthediscountratethatappliedwhentheinvestmentwaspurchased)of€750,000:Other-than-temporaryimpairmentloss250,000InvestmentinJamesbonds250,000Requirement2HTMinvestment,December31,2012UnderIFRS,OTTimpairmentsassociatedwithdebtinvestmentscanberecovered.Therefore,FlowerwouldrecordareversalofOTTimpairmenttoincreasethecarryingvalueoftheJamesinvestmentfrom€750,000to€800,000(thepresentvalueofexpectedfuturecashflowsasofDecember31,2012,computedatthediscountratethatappliedwhentheinvestmentwaspurchased):InvestmentinJamesbonds50,000Recoveryofother-than-temporaryimpairmentloss50,000Requirement3AFSdebtinvestment,December31,2011UnderIFRS,theentiredifferencebetweenamortizedcostandfairvalueisshownasanOTTimpairmentwithrespecttoanAFSinvestment.Therefore,Flowerwouldmakethefollowingjournalentrytoreducethecarryingvalueoftheinvestmentfromitsamortizedcostof€1,000,000tofairvalueof€600,000:Other-than-temporaryimpairmentloss400,000InvestmentinJamesbonds400,00012-40\nChapter12-InvestmentsExercise12-27(concluded)Requirement4:AFSdebtinvestment,December31,2012UnderIFRS,OTTimpairmentsassociatedwithdebtinvestmentscanberecovered.Therefore,FlowerwouldrecordareversalofOTTimpairmenttoincreasethecarryingvalueoftheJamesinvestmentfrom€600,000toitsfairvalueof€875,000:InvestmentinJamesbonds275,000Recoveryofother-than-temporaryimpairmentloss275,000Requirement5:AFSequityinvestment,December31,2012UnderIFRS,OTTimpairmentsassociatedwithequityinvestmentscannotberecovered.Therefore,Flowerwouldjustviewtheincreaseinfairvalueasanunrealizedgain,adjustingthecarryingvalueoftheinvestmentandOCItoreflecttheincreaseinfairvaluefrom€600,000to€875,000:Fairvalueadjustment275,000Netunrealizedholdinggainsandlosses—OCI275,00012-40\nChapter12-InvestmentsExercise5-28Requirement2ThespecificcitationthatspecifiesthecircumstancesandconditionsunderwhichitisappropriatetoaccountforinvestmentsasHeld-to-MaturityisFASBACS320–10–25–4:“Investments—DebtandEquitySecurities—Overall—Recognition—CircumstancesNotConsistentwithHeld-to-MaturityClassification.”Requirement3FASBACS320–10–25–4readsasfollows:“Anentityshallnotclassifyadebtsecurityasheld-to-maturityiftheentityhastheintenttoholdthesecurityforonlyanindefiniteperiod.Consequently,adebtsecurityshallnot,forexample,beclassifiedasheld-to-maturityiftheentityanticipatesthatthesecuritywouldbeavailabletobesoldinresponsetoanyofthefollowingcircumstances:a. Changesinmarketinterestratesandrelatedchangesinthesecurity'sprepaymentriskb. Needsforliquidity(forexample,duetothewithdrawalofdeposits,increaseddemandforloans,surrenderofinsurancepolicies,orpaymentofinsuranceclaims)c. Changesintheavailabilityofandtheyieldonalternativeinvestmentsd. Changesinfundingsourcesandtermse. Changesinforeigncurrencyrisk.”12-40\nChapter12-InvestmentsExercise5-29TheFASBAccountingStandardsCodificationrepresentsthesinglesourceofauthoritativeU.S.generallyacceptedaccountingprinciples.Thespecificcitationforeachofthefollowingitemsis:1.Unrealizedholdinggainsfortradingsecuritiesshouldbeincludedinearnings:FASBACS320–10–35–1a:“Investments—DebtandEquitySecurities—Overall—SubsequentMeasurement—General.”2.Undertheequitymethod,theinvestoraccountsforitsshareoftheearningsorlossesoftheinvesteeintheperiodstheyarereportedbytheinvesteeinitsfinancialstatements:FASBACS323–10–35–4:“Investments—EquityMethodandJointVentures—Overall—SubsequentMeasurement—General.”3.Transfersofsecuritiesbetweencategoriesshallbeaccountedforatfairvalue:FASBACS320–10–35–10:“Investments—DebtandEquitySecurities—Overall—SubsequentMeasurement—General.”4.Disclosuresforavailable-for-salesecuritiesshouldincludetotallossesforsecuritiesthathavenetlossesincludedinaccumulatedothercomprehensiveincome:FASBACS320–10–50–2:“Investments—DebtandEquitySecurities—Overall—Disclosure—SecuritiesClassifiedasAvailableforSale.”12-40\nChapter12-InvestmentsCPA/CMAREVIEWQUESTIONSCPAExamQuestions1.d.2.a.3.d.4.d.5.d.6.c.7.b.8.a.CMAExamQuestions1.c.2.b.3.d.12-40