- 70.00 KB

- 2022-08-09 发布

- 1、本文档由用户上传,淘文库整理发布,可阅读全部内容。

- 2、本文档内容版权归属内容提供方,所产生的收益全部归内容提供方所有。如果您对本文有版权争议,请立即联系网站客服。

- 3、本文档由用户上传,本站不保证质量和数量令人满意,可能有诸多瑕疵,付费之前,请仔细阅读内容确认后进行付费下载。

- 网站客服QQ:403074932

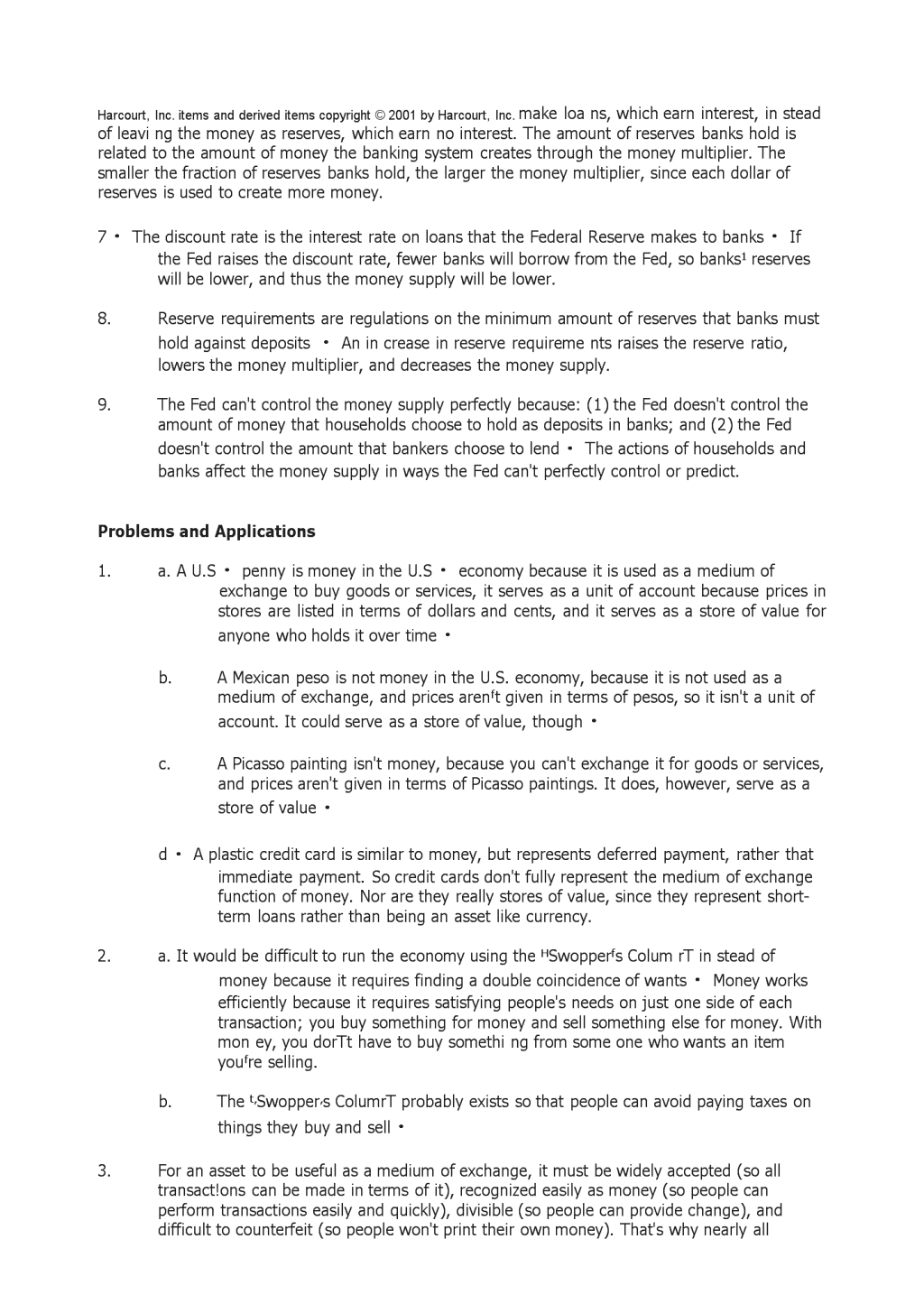

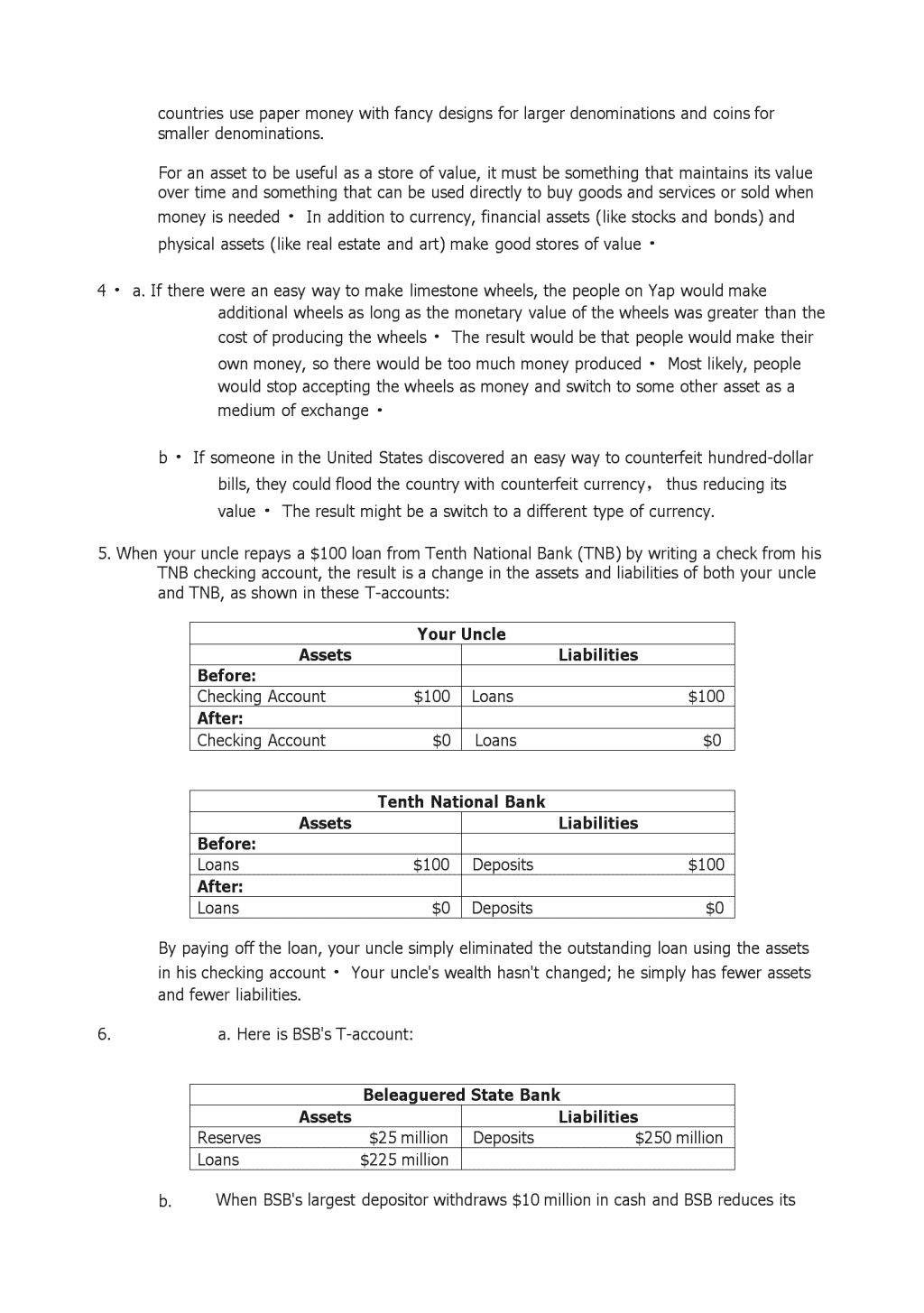

SOLUTIONSTOTEXTPROBLEMS:QuickQuizzes1.Thethreefunctionsofmoneyare:(1)mediumofexchange;(2)unitofaccount;and(3)storeofvalue・Moneyisusedasamediumofexchangebecausemoneyistheitempeopleusetopurchasegoodsandservices.Moneyisusedasaunitofaccountbecauseifstheyardstickpeopleusetopostpricesandrecorddebts.Moneyisusedasastoreofvaluebecauseifsanitempeopleusetotransferpurchasingpowerfromthepresenttothefuture・2.TheprimaryresponsibilitiesoftheFederalReservearetoregulatebanks,ensuringthehealthofthebankingsystem,andtocontrolthequantityofmoneythatismadeavailableintheeconomy.IftheFedwantstoincreasethesupplyofmoney,itusuallydoessobycreatingdollarsandusingthemtopurchasegovernmentbondsfromthepublicinthenation'sbondmarkets・3.Bankscreatemoneywhentheymakeloansandholdafractionoftheamountoftheloansinreserves,resultinginanexpansionofbothmoneyandcreditintheeconomy.IftheFedwantedtouseallthreeofitstoolstodecreasethemoneysupply,itwould:(1)sellgovernmentbondsfromitsportfoliointheopenmarkettoreducethenumberofdollarsincirculation;(2)increasereserverequirementstoreducethemoneycreatedbybanks;and(3)increasethediscountratetodiscouragebanksfromborrowingreservesfromtheFed.QuestionsforReview1・Moneyisdifferentfromotherassetsintheeconomybecauseitisthemostliquidassetavailable・Otherassetsvarywidelyintheirliquidity.2.Commoditymoneyismoneywithintrinsicvalue,likegold,whichcanbeusedforpurposesotherthanasamediumofexchange.Fiatmoneyismoneywithoutintrinsicvalue;ithasnovalueotherthanitsuseasamediumofexchange・Oureconomytodayusesfiatmoney.3.Demanddepositsarebalancesinbankaccountsthatdepositorscanaccessondemandsimplybywritingacheck.Theyshouldbeincludedinthestockofmoneybecausetheycanbeusedtobuygoodsandservices・4.TheFederalOpenMarketCommittee(FOMC)isresponsibleforsettingmonetarypolicyintheUnitedStates・TheFOMCconsistsofthesevenmembersoftheFederalReserveBoardofGovernorsandfiveofthe12presidentsofFederalReserveBanks.MembersoftheBoardofGovernorsareappointedbythepresidentoftheUnitedStatesandconfirmedbytheU.S・Senate.ThepresidentsoftheFederalReserveBanksarechosenbyeachbank'sboardofdirectors・5.IftheFedwantstoincreasethesupplyofmoneywithopen-marketoperations,itpurchasesU.S.governmentbondsontheopenmarket.Thepurchaseincreasesthenumberofdollarsinthehandsofthepublic,thusraisingthemoneysupply.6.Banksdon’thold100percentreservesbecauseifsmoreprofitabletousethereservesto\nHarcourt,Inc.itemsandderiveditemscopyright©2001byHarcourt,Inc.makeloans,whichearninterest,insteadofleavingthemoneyasreserves,whichearnnointerest.Theamountofreservesbanksholdisrelatedtotheamountofmoneythebankingsystemcreatesthroughthemoneymultiplier.Thesmallerthefractionofreservesbankshold,thelargerthemoneymultiplier,sinceeachdollarofreservesisusedtocreatemoremoney.7・ThediscountrateistheinterestrateonloansthattheFederalReservemakestobanks・IftheFedraisesthediscountrate,fewerbankswillborrowfromtheFed,sobanks1reserveswillbelower,andthusthemoneysupplywillbelower.8.Reserverequirementsareregulationsontheminimumamountofreservesthatbanksmustholdagainstdeposits・Anincreaseinreserverequirementsraisesthereserveratio,lowersthemoneymultiplier,anddecreasesthemoneysupply.9.TheFedcan'tcontrolthemoneysupplyperfectlybecause:(1)theFeddoesn'tcontroltheamountofmoneythathouseholdschoosetoholdasdepositsinbanks;and(2)theFeddoesn'tcontroltheamountthatbankerschoosetolend・TheactionsofhouseholdsandbanksaffectthemoneysupplyinwaystheFedcan'tperfectlycontrolorpredict.ProblemsandApplications1.a.AU.S・pennyismoneyintheU.S・economybecauseitisusedasamediumofexchangetobuygoodsorservices,itservesasaunitofaccountbecausepricesinstoresarelistedintermsofdollarsandcents,anditservesasastoreofvalueforanyonewhoholdsitovertime・b.AMexicanpesoisnotmoneyintheU.S.economy,becauseitisnotusedasamediumofexchange,andpricesarenftgivenintermsofpesos,soitisn'taunitofaccount.Itcouldserveasastoreofvalue,though・c.APicassopaintingisn'tmoney,becauseyoucan'texchangeitforgoodsorservices,andpricesaren'tgivenintermsofPicassopaintings.Itdoes,however,serveasastoreofvalue・d・Aplasticcreditcardissimilartomoney,butrepresentsdeferredpayment,ratherthatimmediatepayment.Socreditcardsdon'tfullyrepresentthemediumofexchangefunctionofmoney.Noraretheyreallystoresofvalue,sincetheyrepresentshort-termloansratherthanbeinganassetlikecurrency.2.a.ItwouldbedifficulttoruntheeconomyusingtheHSwopperfsColumrTinsteadofmoneybecauseitrequiresfindingadoublecoincidenceofwants・Moneyworksefficientlybecauseitrequiressatisfyingpeople'sneedsonjustonesideofeachtransaction;youbuysomethingformoneyandsellsomethingelseformoney.Withmoney,youdorTthavetobuysomethingfromsomeonewhowantsanitemyoufreselling.b.Thet,Swopper,sColumrTprobablyexistssothatpeoplecanavoidpayingtaxesonthingstheybuyandsell・3.Foranassettobeusefulasamediumofexchange,itmustbewidelyaccepted(soalltransact!onscanbemadeintermsofit),recognizedeasilyasmoney(sopeoplecanperformtransactionseasilyandquickly),divisible(sopeoplecanprovidechange),anddifficulttocounterfeit(sopeoplewon'tprinttheirownmoney).That'swhynearlyall\ncountriesusepapermoneywithfancydesignsforlargerdenominationsandcoinsforsmallerdenominations.Foranassettobeusefulasastoreofvalue,itmustbesomethingthatmaintainsitsvalueovertimeandsomethingthatcanbeuseddirectlytobuygoodsandservicesorsoldwhenmoneyisneeded・Inadditiontocurrency,financialassets(likestocksandbonds)andphysicalassets(likerealestateandart)makegoodstoresofvalue・4・a.Iftherewereaneasywaytomakelimestonewheels,thepeopleonYapwouldmakeadditionalwheelsaslongasthemonetaryvalueofthewheelswasgreaterthanthecostofproducingthewheels・Theresultwouldbethatpeoplewouldmaketheirownmoney,sotherewouldbetoomuchmoneyproduced・Mostlikely,peoplewouldstopacceptingthewheelsasmoneyandswitchtosomeotherassetasamediumofexchange・b・IfsomeoneintheUnitedStatesdiscoveredaneasywaytocounterfeithundred-dollarbills,theycouldfloodthecountrywithcounterfeitcurrency,thusreducingitsvalue・Theresultmightbeaswitchtoadifferenttypeofcurrency.5.Whenyourunclerepaysa$100loanfromTenthNationalBank(TNB)bywritingacheckfromhisTNBcheckingaccount,theresultisachangeintheassetsandliabilitiesofbothyouruncleandTNB,asshownintheseT-accounts:YourUncleAssetsLiabilitiesBefore:CheckingAccount$100Loans$100After:CheckingAccount$0Loans$0TenthNationalBankAssetsLiabilitiesBefore:Loans$100Deposits$100After:Loans$0Deposits$0Bypayingofftheloan,yourunclesimplyeliminatedtheoutstandingloanusingtheassetsinhischeckingaccount・Youruncle'swealthhasn'tchanged;hesimplyhasfewerassetsandfewerliabilities.6.a.HereisBSB'sT-account:BeleagueredStateBankAssetsLiabilitiesReserves$25millionDeposits$250millionLoans$225millionb.WhenBSB'slargestdepositorwithdraws$10millionincashandBSBreducesits\nloansoutstandingtomaintainthesamereserveratio,itsT-accountisnow:BeleagueredStateBankAssetsLiabilitiesReserves$24millionDeposits$240millionLoans$216millionb.SinceBSBiscuttingbackonitsloans,otherbankswillfindthemselvesshortofreservesandtheymayalsocutbackontheirloansaswell.c.BSBmayfinditdifficulttocutbackonitsloansimmediately,sinceitcan'tforcepeopletopayoffloans.Instead,itcanstopmakingnewloans.Butforatimeitmightfinditselfwithmoreloansthanitwants.Itcouldtrytoattractadditionaldepositstogetadditionalreserves,orborrowfromanotherbankorfromtheFed.2.Ifyoutake$100thatyouheldascurrencyandputitintothebankingsystem,thenthetotalamountofdepositsinthebankingsystemincreasesby$1,000,sinceareserveratioof10percentmeansthemoneymultiplieris1/.10=10.Thusthemoneysupplyincreasesby$900,sincedepositsincreaseby$1,000butcurrencydeclinesby$100・3.Witharequiredreserveratioof10percent,themoneymultipliercouldbeashighas1/.10=10,ifbanksholdnoexcessreservesandpeopledorYtkeepsomeadditionalcurrency.Sothemaximumincreaseinthemoneysupplyfroma$10millionopemarketpurchaseis$100million.Thesmallestpossibleincreaseis$0,ifallthemoneyisheldbybanksasexcessreserves・4.a.Iftherequiredreserveratiois5percent,thenFirstNationalBank'srequiredreservesare$500,000x.05=$25,000.Sincethebank'stotalreservesare$100,000,ithasexcessreservesof$75,000.b・Witharequiredreserveratioof5percent,themoneymultiplieris1/.05=20.IfFirstNationallendsoutitsexcessreservesof$75,000,themoneysupplywilleventuallyincreaseby$75,000x20=$1,500,000.10・a.Witharequiredreserveratioof10percentandnoexcessreserves,themoneymultiplieris1/.10=10.IftheFedsells$1millionofbonds,reserveswilldeclineby$1millionandthemoneysupplywillcontractby10x$1million=$10million.b.Banksmightwishtoholdexcessreservesiftheyneedtoholdthereservesfortheirday-to-dayoperations,suchaspayingotherbanksforcustomers1transactions,makingchange,cashingpaychecks,andsoon.Ifbanksincreaseexcessreservessuchthatthere'snooverallchangeinthetotalreserveratio,thenthemoneymultiplierdoesn'tchangeandthere'snoeffectonthemoneystock・11.a.Withbanksholdingonlyrequiredreservesof10percent,themoneymultiplieris1/.10=10.Sincereservesare$100billion,themoneystockis10x$100billion=$1,000billion.b・Iftherequiredreserveratioisraisedto20percent,themoneymultiplierdeclinesto1/.20=5.Withreservesof$100billion,themoneystockwoulddeclineto$500billion,adeclineof$500billion.Reserveswouldbeunchanged,sinceallavailablecurrencywouldbeheldbybanksasreserves・12.a.Ifpeopleholdallmoneyascurrency,thequantityofmoneyis$2,000.\nb.Ifpeopleholdallmoneyasdemanddepositsatbankswith100percentreserves,thequantityofmoneyis$2,000.c・Ifpeoplehave$1,000incurrencyand$1,000indemanddeposits,thequantityofmoneyis$2,000.b.Ifbankshaveareserveratioof10percent,themoneymultiplieris1/.10=10.Soifpeopleholdallmoneyasdemanddeposits,thequantityofmoneyis10x$2,000=$20,000.c.Ifpeopleholdequalamountsofcurrency(C)anddemanddeposits(D)andthemoneymultiplierforreservesis105thentwoequationsmustbesatisfied:(1)C=D,sothatpeoplehaveequalamountsofcurrencyanddemanddeposits;and(2)10x($2,000-C)=D,sothatthemoneymultiplier(10)timesthenumberofdollarbillsthataren'tbeingheldbypeople($2,000-C)equalstheamountofdemanddeposits(D)・Usingthefirstequationinthesecondgives10x($2,000-D)=D,or$20,000・10D=D,or$20,000=11D,soD=$1,818.18.ThenC=$1,818.18.ThequantityofmoneyisC+D=$3,636.36.