- 429.62 KB

- 2022-09-27 发布

- 1、本文档由用户上传,淘文库整理发布,可阅读全部内容。

- 2、本文档内容版权归属内容提供方,所产生的收益全部归内容提供方所有。如果您对本文有版权争议,请立即联系网站客服。

- 3、本文档由用户上传,本站不保证质量和数量令人满意,可能有诸多瑕疵,付费之前,请仔细阅读内容确认后进行付费下载。

- 网站客服QQ:403074932

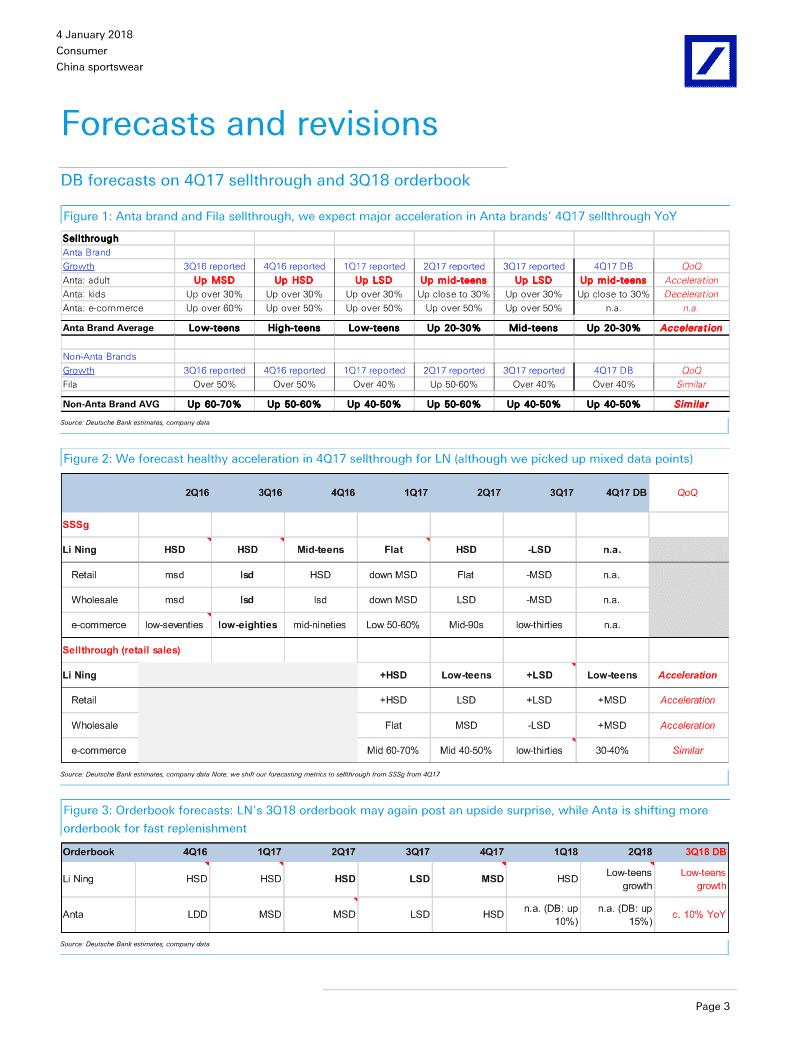

DeutscheBankMarketsResearchAsiaIndustryDateChinaChinasportswear4January2018ConsumerForecastChangeJohnChouAnneLing4Q17channelobservations:theResearchAnalystResearchAnalyst(+852)22036196(+852)22036177winteraccelerationjohn.chou@db.comanne.ling@db.comIndustry-wideaccelerationin4Q17bodeswellfor2018;LN’sinvestmentsKeyChangesThestrengthseeninoff-linesportswearretailislikelytobedrivenbyimprovedCompanyTargetPriceRatinge-commerceresilienceandconsumersentiment.3Q18orderbookgrowthalso2020.HK37.00to-appearssolidwithLiNing(LN)testingamoreflexibleordermechanismand40.00(HKD)Nikeseeingstrongimprovementinproductdesigns.OnLN,webelieveitcould2331.HK7.70to7.50(HKD)-accelerateinvestmentin2018toaddresssome“imbalances”.WethusseeSource:DeutscheBankpressureonits2018netmarginguidance.WemaintainpreferenceonAntaoverLNandPouSheng(PS).ToppicksAnta(2020.HK),HKD35.60BuySolidaccelerationinsellthroughgrowthin4Q17Source:DeutscheBankSellthroughacceleration:weexpect4Q17off-linesellthroughgrowthtobestrongerthanthatin2Q17(Figs.1&2),attributabletoconsumerconfidence,newbigstoresanddownjackets(seebelowlink)Industryvaluation:Wevaluethesportinggoodssectorhttp://pull.db-gmresearch.com/p/650-5C60/245964020/0900b8c08df056cd.pdfusingDCF,asweexpectinvestorstoImprovedbalancebetweene-commerceandoff-line:interestingly,thefocusonthesector’slong-termvalueofflinee-commercecannibalizationappearedtohaveeasedinNov.2017.creation.ForWACC,wefollowDB’sLeadingshoppingmallsin2017didnotofferheavyretaildiscountforviewonRFRandERPwhileassigningSingles’DaybutstilldeliveredhealthySSSg.abetabetween0.9to1.3andterminalgrowthof1-2%.Retaildiscountcontinuestoshowindustry-wideimprovements:wewitnessedanotherYoYimprovementinretaildiscountin4Q17(lessIndustrydownsiderisks:markdowns)fordomesticsportswearbrandsNike,AdidasandFila.WeWeakercyclicalrecovery,weakernotethatAntadistributorsdeliberatelyreducedmarkdownsduringpre-innovationthatfailstodrivenew“Jan-1”promotions.LNcontinuestodrivesustainableimprovements.demand,sportssegmentationande-3Q18orderbook(Figure3):LNisallowingdistributorstotakeonmorecommerce’sinabilitytodrivesectorinventory.Inaddition,itmayhavealloweddistributorstoreturnsomegrowth.orderedproducts.ForAnta,distributorsingeneralfeel3Q18(autumn)islesssignificantvs.thatin2Qand4Q.Industryupsiderisks(PS):LessstoreclosuresandbetterthanLN:twoimbalancesin2H17,butmanagementisaddressingtheissuesexpectedinventoryefficiency.WeareencouragedbyLN’sretailperformancein4Q17butbelievetwoissuesrequiremonitoring:(1)Sellthroughismoreconcentratedtowardsapparel,alsoThisreportchangesforecastsforevidencedbysellout;wewitnessedextremelystrongselloutforLN’sapparelinmultiplestocks4Q17(downjacketsstartedtoreportshortage)butfootwearselloutwasrelativelylagging.(2)Performancegapbetweenoldandnewstores,mostevidencedbythegapbetweenSSSgandsellthroughgrowth,withworsened3Q17channelobservationsdeteriorationseeninsomeolderstreet-sidestores.http://pull.db-gmresearch.com/p/663-Assuch,weexpectLNtoacceleratechannelinvestment.Weseepressureon72A2/10712231/0900b8c08da87ec5.pdfLN’s2018netmarginguidanceandcutDBe2018/19earningsby14%/7%,butweremainmoreoptimisticthanconsensusin2019(Figures4,5,6).Singles’Daychannelobservationshttp://pull.db-gmresearch.com/p/664-Anta:Adultoff-linesellthroughmaycontinuetopostupsidesurprisesin2018;Fila’smultipleinitiativesin20189926/284008183/0900b8c08dd64e4c.pdfFila:webelieveFilahaslaunchedanaggressivegrowthtargetfor2018.WesensemultipleinitiativesincludingFilaKids,largestoreinvestments,FilaFusion(anewbrand),FilaOutletandexpansionintofootwear.________________________________________________________________________________________________________________DeutscheBankAG/HongKongDistributedon:04/01/201809:00:00GMTDeutscheBankdoesandseekstodobusinesswithcompaniescoveredinitsresearchreports.Thus,investorsshouldbeawarethatthefirmmayhaveaconflictofinterestthatcouldaffecttheobjectivityofthisreport.Investorsshouldconsiderthisreportasonlyasinglefactorinmakingtheirinvestmentdecision.DISCLOSURESANDANALYSTCERTIFICATIONSARELOCATEDINAPPENDIX1.MCI(P)083/04/2017.7T2se3r0Ot6kwoPa\n4January2018ConsumerChinasportswearPS,BelleandinternationalssportswearbrandsinChinaSimilaraccelerationtrendbyNikeandAdidiasinChinaWebelievetheSSSgofPSandBelle’sNikeandAdidasacceleratedin4Q17(bothreachedlow-teenspptYoY,basedonourestimates).TheaccelerationisespeciallyprominentatNike.ForBelle,itwasstrongSSSgcoupledwithimprovedretaildiscountYoYwhileforPS,itcontinueditspromotionalactivitiesduring4Q17,furtheringitsemergingbrandsclean-up.2018products:Nikerevampingfunctionalcollections,AdidasexpandingSKUWebelieveNikeandAdidashaveconcludedtheir3Q18Chinasalesfairs.Basedondistributors’comments,weseemeaningfulimprovementinNike’s2018productdesigns(especiallyfunctionallinesincludingrunningandbasketball).AdidasappearstoexpanditsSKUtocovermorelifestyleproductsin2018.PS:temporaryscaleddownstoreclosurein4Q17,alleyesonpre-CNYpromotioncampaignAccordingtoourchannelchecks,PS’storeclosurewasseeminglylesssignificantin4Q17vs.thatin3Q17,in-linewithnormalseasonality.Webelievea1H18(especiallypre-CNY)promotioncampaignisimportantforPSmanagementtotesttheresultsofitsrestructuringin2017.Ifapre-CNYcampaignresultsweretocomeinlesssuccessful,PSmightaccelerateitsrestructuringin2018andprovideveryconservativemarginguidance(alongwiththeresultsreleasescheduledinlateMarch).Wecontinuetostayonthesidelinesregardingthestock,duetouncertaintiesoveritsrestructuringtimetable.Page2DeutscheBankAG/HongKong\n4January2018ConsumerChinasportswearForecastsandrevisionsDBforecastson4Q17sellthroughand3Q18orderbookFigure1:AntabrandandFilasellthrough,weexpectmajoraccelerationinAntabrands’4Q17sellthroughYoYSellthroughAntaBrandGrowth3Q16reported4Q16reported1Q17reported2Q17reported3Q17reported4Q17DBQoQAnta:adultUpMSDUpHSDUpLSDUpmid-teensUpLSDUpmid-teensAccelerationAnta:kidsUpover30%Upover30%Upover30%Upcloseto30%Upover30%Upcloseto30%DecelerationAnta:e-commerceUpover60%Upover50%Upover50%Upover50%Upover50%n.a.n.a.AntaBrandAverageLow-teensHigh-teensLow-teensUp20-30%Mid-teensUp20-30%AccelerationNon-AntaBrandsGrowth3Q16reported4Q16reported1Q17reported2Q17reported3Q17reported4Q17DBQoQFilaOver50%Over50%Over40%Up50-60%Over40%Over40%SimilarNon-AntaBrandAVGUp60-70%Up50-60%Up40-50%Up50-60%Up40-50%Up40-50%SimilarSource:DeutscheBankestimates,companydataFigure2:Weforecasthealthyaccelerationin4Q17sellthroughforLN(althoughwepickedupmixeddatapoints)2Q163Q164Q161Q172Q173Q174Q17DBQoQSSSgLiNingHSDHSDMid-teensFlatHSD-LSDn.a.RetailmsdlsdHSDdownMSDFlat-MSDn.a.WholesalemsdlsdlsddownMSDLSD-MSDn.a.e-commercelow-seventieslow-eightiesmid-ninetiesLow50-60%Mid-90slow-thirtiesn.a.Sellthrough(retailsales)LiNing+HSDLow-teens+LSDLow-teensAccelerationRetail+HSDLSD+LSD+MSDAccelerationWholesaleFlatMSD-LSD+MSDAcceleratione-commerceMid60-70%Mid40-50%low-thirties30-40%SimilarSource:DeutscheBankestimates,companydataNote:weshiftourforecastingmetricstosellthroughfromSSSgfrom4Q17Figure3:Orderbookforecasts:LN’s3Q18orderbookmayagainpostanupsidesurprise,whileAntaisshiftingmoreorderbookforfastreplenishmentOrderbook4Q161Q172Q173Q174Q171Q182Q183Q18DBLow-teensLow-teensLiNingHSDHSDHSDLSDMSDHSDgrowthgrowthn.a.(DB:upn.a.(DB:upAntaLDDMSDMSDLSDHSDc.10%YoY10%)15%)Source:DeutscheBankestimates,companydataDeutscheBankAG/HongKongPage3\n4January2018ConsumerChinasportswearEarningsrevisionsLN:factor-inheavierinvestmentsin2018Wearecomfortablewithour2017earningsforecastofRMB524mn.However,weseepressureforLNtomeetits2018netmarginguidance(c.8%,orup250bpsYoY;Figure5)duetoinvestments:(1)Heavierinvestmentsinchannel:webelievesomeofLN’sefficiencyprogrammeshavebeendelayedinto2018,whichincludeinitiativestobuybacksomeoutletstoresfromdistributors.(2)LNmayhavegivendistributorsmoreflexibilitytoreturnproductsordered.Thiscouldleadtosomeadditionalexpenses,inourview.(3)Potentiallymoremarketingexpenses.(4)Arecentlyannouncedmanagementincentiveprogramme(announcementinthelinkbelow).http://www.hkexnews.hk/listedco/listconews/SEHK/2017/1220/LTN20171220756.pdfFigure4:LN:earningsrevisions:(1)heavierinvestmentsin2018,(2)slightlystrongerrevenuegrowthand(3)managementincentiveprogramNewforecastOldforecastNewvs.OldforecastRMBmYEDec2017E2018E2019E2017E2018E2019E2017E2018E2019ERevenue8,96410,21511,5768,99010,18511,487-0.3%0.3%0.8%Grossprofit4,3105,0975,8274,3235,0825,834-0.3%0.3%-0.1%EBIT5748551,3975691,0381,5400.9%-17.7%-9.3%HeadlineNP5247511,1905178771,2761.5%-14.4%-6.7%ProfitabilityGrossmargin48.1%49.9%50.3%48.1%49.9%50.8%0.0%0.0%-0.5%EBITmargin6.4%8.4%12.1%6.3%10.2%13.4%0.1%-1.8%-1.3%Netmargin5.8%7.3%10.3%5.7%8.6%11.1%0.1%-1.3%-0.8%Source:DeutscheBankestimates,companydataFigure5:DBforecastsindetails,andcompanyguidance20161H17A2017E2018E2019E2017Guidance2018AssumptionsDBcommentsRevenueYoY13%11%12%14%13%Low-teensMid-teensRetail7%6%8%10%8%HSDtolow-teensHSDtolow-teens(1)newstorescontributingc.5%,(2)SSSg=LSD-MSDWholesale5%4%5%9%8%LSDtoMSDMSDtoHSDAllowingdistributorstoordermorefor2018e-commerce89%59%45%35%33%Up40-50%Up20-30%AimingtoboostprofitabilityInternational34%12%14%10%5%GrossMargin46.0%47.7%48.1%49.9%50.3%2017-19:up2pptYoYp.a.Retail61%55%59%62%62%2017:n.a.;optimal=mid-60s1Q17&3Q17retaildiscountmayhavehurtGMWholesale36%40%40%42%43%2017:40%;optimal=mid-40sReducingrebate&sourcingefficiencye-commerce50%53%52%51%51%2017:50%;optimal=low-50sStrongretaildiscounttrendInternational43%45%43%43%43%A&Ptosales12.3%11.3%11.1%10.9%10.3%Reach10-11%in2018or2019(around11%in2018)Conservative,notfullyconsideringCBAsavingsOtherOPEXtosales26.9%27.6%27.4%28.0%25.7%ReflectingnewbrandinvestmentsRecur.netmargin3.2%4.6%5.9%7.3%10.3%2017:5.5%,2018at7-7.5%(beforeincentiveprogram)Cutfrom2.5pptincreasep.a.in2018&2019Source:DeutscheBankestimates,companydataPage4DeutscheBankAG/HongKong\n4January2018ConsumerChinasportswearFigure6:DBevs.consensus:wearemuchmoreoptimisticin2019aswebelieveinvestmentsin2018willbearfruitNewforecastMarketconsensusNewvs.MarketforecastRMBmYEDec2017E2018E2019E2017E2018E2019E2017E2018E2019ERevenue8,96410,21511,5768,93910,00511,0780.3%2.1%4.5%Grossprofit4,3105,0975,8274,2454,8375,4201.5%5.4%7.5%EBIT5748551,3975638641,1461.9%-1.0%21.9%HeadlineNP5247511,1904997379455.0%1.9%25.9%ProfitabilityGrossmargin48.1%49.9%50.3%47.5%48.3%48.9%0.6%1.6%1.4%EBITmargin6.4%8.4%12.1%6.3%8.6%10.3%0.1%-0.3%1.7%Netmargin5.8%7.3%10.3%5.6%7.4%8.5%0.3%0.0%1.7%Source:DeutscheBankestimates,BloombergFinanceLPconsensusAnta:strongdistributorordersfor2H18droveearningsupgradeWeslightlyreviseupourearningsforecaststoreflectapotentiallystronger2H18orderbook,especially4Q18.Althoughthe4Q18salesfairwillonlybehostedafterChineseNewYear,webelievethestrongsellthroughin4Q17willlikelypromptdistributorstorestockmorefor4Q18,leadingtostrongorderbookgrowth.Figure7:Anta:earningsrevisions:factoringstrongerdistributorordersNewforecastOldforecastNewvs.OldforecastRMBmYEDec2017E2018E2019E2017E2018E2019E2017E2018E2019ERevenue16,16519,99424,39116,09419,62023,8320.4%1.9%2.3%Grossprofit8,21910,38112,9048,18210,18712,6090.4%1.9%2.3%EBIT4,1004,9686,1114,0834,8805,9780.4%1.8%2.2%HeadlineNP3,0433,7524,6153,0303,6874,5160.4%1.8%2.2%ProfitabilityGrossmargin50.8%51.9%52.9%50.8%51.9%52.9%0.0%0.0%0.0%EBITmargin25.4%24.8%25.1%25.4%24.9%25.1%0.0%0.0%0.0%Netmargin18.8%18.8%18.9%18.8%18.8%19.0%0.0%0.0%0.0%Source:DeutscheBankestimates,companydataFigure8:DBevs.consensus:weareslightlymorepositivethatconsensusNewforecastMarketforecastNewvs.marketforecastRMBmYEDec2017E2018E2019E2017E2018E2019E2017E2018E2019ERevenue16,16519,99424,39116,15019,60322,9950.1%2.0%6.1%Grossprofit8,21910,38112,9048,18110,07112,1410.5%3.1%6.3%EBIT4,1004,9686,1114,0214,8815,9052.0%1.8%3.5%HeadlineNP3,0433,7524,6153,0343,6694,3880.3%2.3%5.2%ProfitabilityGrossmargin50.8%51.9%52.9%50.7%51.4%52.8%0.2%0.6%0.1%EBITmargin25.4%24.8%25.1%24.9%24.9%25.7%0.5%-0.1%-0.6%Netmargin18.8%18.8%18.9%18.8%18.7%19.1%0.0%0.0%-0.2%Source:DeutscheBankestimates,BloombergFinanceLPconsensusPS:maintainingforecastsunchangedDeutscheBankAG/HongKongPage5\n4January2018ConsumerChinasportswearValuationandrisksAnta:increaseDCF-basedtargetpricetoHKD40Theincreaseisdrivenbyupwardearningsrevisions.WevalueAntausingaDCFmethodologyasweexpectinvestorstofocusonitslong-termgrowthprofile.Costofequityof10.6%:risk-freerate=3.9%(DeutscheBankassumption),equityriskpremium=5.6%(DeutscheBankassumption),andabetaof1.3.Weassumeaperpetualgrowthrateof2%,inlinewithHongKong&Chinaconsumerdiscretionaryspaceof1-2%.Anta:downsiderisksDownsideriskstoourview:(1)intensecompetitionandanyincreaseinindustrydiscounting;(2)weaker-than-expectedmacroconditionsthatwoulddampendemand;(3)higher-than-expectedchannelinventory;and(4)Filafailingtodrivesustainablegrowth.LN:cutDCF-basedtargetpricetoHKD7.5Thetargetpricecutisdrivenbydownwardearningsrevisions.WevalueLiNingusingaDCFmethodologyasweexpectinvestorstofocusonitslong-termgrowthprofile.Weassumecostofequityof11.2%:risk-freerate=3.9%(DeutscheBankassumption),equityriskpremium=5.6%(DeutscheBankassumption),andbetaof1.3.Weassumeaperpetualgrowthrateof1%,inlinewithHongKong&Chinaconsumerdiscretionaryspaceof1-2%.LN:downsiderisksDownsiderisks:(1)Execution:failuretodeliverlong-termmarginguidancewilltriggerde-rating.(2)Transitionalvolatilityingrossmargin:weaker-than-expectedimprovementingrossmarginisthemostsignificantdownsiderisktoourthesis.Thismaystemfromdisappointingretaildiscountfortheretailbusinessand/orlowersell-throughcontributionfromnewproducts.(3)Weakerrevenuegrowth,potentiallydrivenbyinventoryshortage.(4)Weaker-than-expectedimprovementinstoreefficiency.PS:valuationWeusediscountedcashflow(DCF)asourprimaryapproachtovaluePS'sshares.WeadopttheDCFmethodologyasweexpectinvestorstofocusonPS'slong-termvaluecreation.InourDCFmodel,wederiveaWACCof10.18%withacostofequityof10.34%(risk-freerate3.9%,beta1.15,marketriskpremium5.6%)andacostofdebtof7.2%.Weassumealong-termgrowthrateof2%,whichisinlinewithDeutscheBank'sChinasportsretaileraverage.WenotethatPSis100%exposedtotheChinamarket.PS:risksUpsiderisk(downsiderisk)toourviewincludes:(1)less(more)storesbeingclosedatfaster(slower)pace.(2)More(less)effectiveinventoryoptimization.(3)More(less)successfulreductionofnon-cashlossesafterthecleanup,(4)Moresuccessfulstoreformatreformandefficiencyprogrammewillleadtobetterresilienceagainste-commercecompetition.Onthedownside,iftherestructuringfails,itwouldbeincreasinglydifficultforPouShengtosecuremarketshareamidintensifyingcompetitionfrome-commerce.Page6DeutscheBankAG/HongKong\n4January2018ConsumerChinasportswearModelupdated:04January2018Fiscalyearend31-Dec2014201520162017E2018E2019ERunningthenumbersFinancialSummaryAsiaDBEPS(CNY)-0.52-0.050.120.220.310.48ReportedEPS(CNY)-0.480.010.290.210.310.48ChinaDPS(CNY)0.000.000.000.000.110.18BVPS(CNY)1.41.72.02.02.22.6Textiles&ApparelWeightedaverageshares(m)1,6252,1592,2162,2762,2762,276LiNingCoLtdAveragemarketcap(CNYm)6,5146,6708,12510,35010,35010,350Enterprisevalue(CNYm)7,0066,1346,3727,8517,1956,301Reuters:2331.HKBloomberg:2331HKValuationMetricsP/E(DB)(x)nmnm31.725.418.011.3BuyP/E(Reported)(x)nm466.212.625.718.011.3Price(3Jan18)HKD6.60P/BV(x)2.212.022.082.772.482.13TargetPriceHKD7.50FCFYield(%)nm0.76.45.86.19.4DividendYield(%)0.00.00.00.02.13.352WeekrangeHKD4.52-7.39EV/Sales(x)1.00.80.80.90.70.5MarketCap(m)HKDm12,443EV/EBITDA(x)nm17.110.28.46.03.6EV/EBIT(x)nm58.220.613.78.44.5USDm1,592IncomeStatement(CNYm)CompanyProfileSalesrevenue6,7287,8128,0158,96410,21511,576LiNingisaleadingPRCsportsbrand,specializingintheGrossprofit2,8863,4433,6894,3105,0975,827designandthedistributionoffootwearandaccessoriesEBITDA-4393596269321,1991,741underthebrandnameLiNing.Depreciation198254318358344345Amortisation000000EBIT-6381053095748551,397Netinterestincome(expense)-143-134-10813414Associates/affiliates77142120132145Exceptionals/extraordinaries109190390-900Otherpre-taxincome/(expense)000000Profitbeforetax-6651687336989911,555PricePerformanceIncometaxexpense7910032153220345Minorities3853582020208.0Otherpost-taxincome/(expense)0000007.0Netprofit-781146435247511,1906.0DBadjustments(includingdilution)-57-116-3877005.0DBNetprofit-838-1022575317511,1904.0CashFlow(CNYm)3.0Cashflowfromoperations-5703738499971,0651,526Jan16Apr16Jul16Oct16Jan17Apr17Jul17Oct17NetCapex-327-327-327-269-306-347LiNingCoLtdHANGSENGINDEX(Rebased)Freecashflow-897465227287581,178Equityraised/(boughtback)01,1721,067000MarginTrendsDividendspaid0000-101-285Netinc/(dec)inborrowings480-249-1,07500016Otherinvesting/financingcashflows22744260012Netcashflow-19097351875465789484Changeinworkingcapital5819337660-4200-4BalanceSheet(CNYm)-8Cashandotherliquidassets1,0341,8131,9552,6993,3564,250-12Tangiblefixedassets1,5009061,00991988288414151617E18E19EGoodwill/intangibleassets000000EBITDAMarginEBITMarginAssociates/investments2002078049241,0561,201Otherassets3,3053,9713,0133,2443,6134,041Growth&ProfitabilityTotalassets6,0406,8976,7807,7878,90710,377Interestbearingdebt1,5251,2772012012012012030Otherliabilities2,3452,2102,5823,0183,5934,2092015Totalliabilities3,8703,4872,7833,2203,7944,41110Shareholders'equity1,9523,1803,9954,5195,0445,877010-10Minorities21823134969895-20Totalshareholders'equity2,1693,4113,9974,5685,1135,966-30Netdebt491-537-1,753-2,498-3,155-4,0490-4014151617E18E19EKeyCompanyMetricsSalesgrowth(%)15.516.12.611.813.913.3Salesgrowth(LHS)ROE(RHS)DBEPSgrowth(%)20.690.9na86.841.358.5SolvencyEBITDAMargin(%)-6.54.67.810.411.715.0EBITMargin(%)-9.51.33.96.48.412.1404Payoutratio(%)nm0.00.00.034.334.3203ROE(%)-33.70.617.912.315.721.803Capex/sales(%)4.94.24.13.03.03.02-20Capex/depreciation(x)1.61.31.00.80.91.02-40Netdebt/equity(%)22.7-15.7-43.9-54.7-61.7-67.91-601Netinterestcover(x)nm0.82.9nmnmnm-800Source:Companydata,DeutscheBankestimates14151617E18E19ENetdebt/equity(LHS)Netinterestcover(RHS)JohnChou+85222036196john.chou@db.comDeutscheBankAG/HongKongPage7\n4January2018ConsumerChinasportswearModelupdated:04January2018Fiscalyearend31-Dec2014201520162017E2018E2019ERunningthenumbersFinancialSummaryAsiaDBEPS(CNY)0.680.810.951.161.401.72ReportedEPS(CNY)0.680.810.951.161.401.72ChinaDPS(CNY)0.480.570.670.800.981.21BVPS(CNY)3.13.43.85.25.66.1Textiles&ApparelWeightedaverageshares(m)2,4952,4992,5082,6342,6782,678AntaAveragemarketcap(CNYm)26,01036,96141,41574,06274,06274,062Enterprisevalue(CNYm)20,57931,35834,83563,20362,32461,027Reuters:2020.HKBloomberg:2020HKValuationMetricsP/E(DB)(x)15.318.217.425.621.117.2BuyP/E(Reported)(x)15.318.217.425.621.117.2Price(3Jan18)HKD35.60P/BV(x)3.495.035.195.745.304.85TargetPriceHKD40.00FCFYield(%)5.54.86.23.64.45.6DividendYield(%)4.63.84.12.73.34.152WeekrangeHKD21.35-36.80EV/Sales(x)2.32.82.63.93.12.5MarketCap(m)HKDm89,040EV/EBITDA(x)9.410.910.214.411.79.4EV/EBIT(x)10.211.610.915.412.510.0USDm11,391IncomeStatement(CNYm)CompanyProfileSalesrevenue8,92311,12613,34616,16519,99424,391AntaSportsProductsLimiteddesigns,develops,Grossprofit4,0275,1856,4598,21910,38112,904manufactures,andmarketssportswear,includingsportsEBITDA2,1782,8853,4294,3895,3066,484footwearandapparelforprofessionalsandthegeneralDepreciation159188226289338373public.Amortisation000000EBIT2,0192,6973,2034,1004,9686,111Netinterestincome(expense)224133108102195225Associates/affiliates000000Exceptionals/extraordinaries000000Otherpre-taxincome/(expense)000000Profitbeforetax2,2432,8293,3114,2025,1636,336PricePerformanceIncometaxexpense5107418661,0981,3481,654Minorities32485961646740Otherpost-taxincome/(expense)00000036Netprofit1,7002,0412,3863,0433,7524,6153228DBadjustments(includingdilution)00000024DBNetprofit1,7002,0412,3863,0433,7524,6152016CashFlow(CNYm)12Cashflowfromoperations1,6152,2282,9943,4824,2555,199Jan16Apr16Jul16Oct16Jan17Apr17Jul17Oct17NetCapex-196-463-421-647-800-732AntaHANGSENGINDEX(Rebased)Freecashflow1,4191,7662,5732,8353,4554,467Equityraised/(boughtback)0003,36100MarginTrendsDividendspaid-878-1,424-1,675-1,917-2,577-3,170Netinc/(dec)inborrowings858-18-39200-30028.0Otherinvesting/financingcashflows-184-1707800027.0Netcashflow1,2141545844,27987999726.0Changeinworkingcapital-421-106291-741-148-16325.024.0BalanceSheet(CNYm)23.0Cashandotherliquidassets6,7796,9337,51711,79612,67513,67222.0Tangiblefixedassets1,8872,2142,5952,9533,4153,77414151617E18E19EGoodwill/intangibleassets000000EBITDAMarginEBITMarginAssociates/investments000000Otherassets2,7173,3554,1114,7055,5546,522Growth&ProfitabilityTotalassets11,38412,50214,22419,45521,64523,968Interestbearingdebt1,3481,3309389389386383035Otherliabilities2,0312,3583,3904,2865,2866,4582530Totalliabilities3,3793,6884,3275,2246,2247,0962025Shareholders'equity7,7958,5809,54913,82314,94816,333201515Minorities2092353484094735401010Totalshareholders'equity8,0058,8149,89614,23115,42116,87255Netdebt-5,431-5,603-6,579-10,859-11,737-13,0340014151617E18E19EKeyCompanyMetricsSalesgrowth(%)22.524.720.021.123.722.0Salesgrowth(LHS)ROE(RHS)DBEPSgrowth(%)29.319.516.521.821.323.0SolvencyEBITDAMargin(%)24.425.925.727.126.526.6EBITMargin(%)22.624.224.025.424.825.10Payoutratio(%)70.969.770.468.970.070.0-20ROE(%)22.724.926.326.026.129.5Capex/sales(%)2.24.23.24.04.03.0-40Capex/depreciation(x)1.22.51.92.22.42.0-60Netdebt/equity(%)-67.8-63.6-66.5-76.3-76.1-77.3-80Netinterestcover(x)nmnmnmnmnmnm-100Source:Companydata,DeutscheBankestimates14151617E18E19ENetdebt/equity(LHS)Netinterestcover(RHS)JohnChou+85222036196john.chou@db.comPage8DeutscheBankAG/HongKong\n4January2018ConsumerChinasportswearModelupdated:15November2017Fiscalyearend31-Dec2014201520162017E2018E2019ERunningthenumbersFinancialSummaryAsiaDBEPS(CNY)0.010.080.110.080.110.13ReportedEPS(CNY)0.010.070.110.070.100.12HongKongDPS(CNY)0.000.000.050.000.010.01BVPS(CNY)1.01.11.21.21.31.4Textiles&ApparelWeightedaverageshares(m)5,3685,3265,2325,2335,2335,233PouShengAveragemarketcap(CNYm)2,3514,2309,4785,1905,1905,190Enterprisevalue(CNYm)3,2064,22210,3326,0796,0495,942Reuters:3813.HKBloomberg:3813HKValuationMetricsP/E(DB)(x)31.410.216.212.09.17.4HoldP/E(Reported)(x)84.610.717.113.410.08.0Price(3Jan18)HKD1.16P/BV(x)0.601.401.640.790.740.68TargetPriceHKD1.20FCFYield(%)17.514.8nmnm0.82.6DividendYield(%)0.00.02.60.01.01.352WeekrangeHKD1.06-2.22EV/Sales(x)0.30.30.60.30.30.3MarketCap(m)HKDm6,240EV/EBITDA(x)8.05.28.85.24.53.9EV/EBIT(x)15.67.011.27.76.25.2USDm798IncomeStatement(CNYm)CompanyProfileSalesrevenue12,20214,46616,23618,44320,05721,960PouShengInternational(Holdings)LimitedisoneoftheGrossprofit3,7735,0296,0196,7457,2547,833largestsportswearretailersinMainlandChinaundertheEBITDA4028101,1741,1731,3511,525brandofYYSports.ItsbrandportfoliooffootwearDepreciation196211250379382389includesNike,Adidas,Asics,Reebok,PUMA...etc.Amortisation000000EBIT2065999247949691,137Netinterestincome(expense)-39-37-51-89-77-67Associates/affiliates000000Exceptionals/extraordinaries000000Otherpre-taxincome/(expense)-42-30-42-67-70-74Profitbeforetax125532832638821996PricePerformanceIncometaxexpense86149262232287339Minorities11-1392522202.8Otherpost-taxincome/(expense)0000002.4Netprofit283975613815116372.0DBadjustments(includingdilution)4722294246491.6DBNetprofit754185894235576861.2CashFlow(CNYm)0.8Cashflowfromoperations573915-11528630708Jan16Apr16Jul16Oct16Jan17Apr17Jul17Oct17NetCapex-162-289-473-600-588-576PouShengHANGSENGINDEX(Rebased)Freecashflow410626-484-7242131Equityraised/(boughtback)000000MarginTrendsDividendspaid00-920-51-64Netinc/(dec)inborrowings-438-7941,005-76008Otherinvesting/financingcashflows3668-1346060586Netcashflow9-99295-8851126Changeinworkingcapital324680-945-367-228-2665BalanceSheet(CNYm)3Cashandotherliquidassets2692974833954465722Tangiblefixedassets1,2801,4881,7001,7381,9442,13114151617E18E19EGoodwill/intangibleassets000000EBITDAMarginEBITMarginAssociates/investments17612569717274Otherassets6,4596,7177,7928,4348,8809,481Growth&ProfitabilityTotalassets8,1858,62710,04410,63811,34212,258Interestbearingdebt1,2113691,3761,3001,3001,3002010Otherliabilities1,5812,4702,5342,8553,1143,488158Totalliabilities2,7922,8393,9104,1554,4144,7886Shareholders'equity5,3035,7426,1046,4286,8507,37310Minorities9045305577984Totalshareholders'equity5,3925,7886,1346,4836,9287,47052Netdebt941728939058547280014151617E18E19EKeyCompanyMetricsSalesgrowth(%)11.618.512.213.68.89.5Salesgrowth(LHS)ROE(RHS)DBEPSgrowth(%)-57.7460.642.6-28.231.723.1SolvencyEBITDAMargin(%)3.35.67.26.46.76.9EBITMargin(%)1.74.15.74.34.85.22020Payoutratio(%)0.00.043.60.010.010.0ROE(%)0.57.29.56.17.79.01515Capex/sales(%)1.32.13.13.32.92.61010Capex/depreciation(x)0.81.42.01.61.51.5Netdebt/equity(%)17.51.214.614.012.39.755Netinterestcover(x)5.216.418.38.912.617.000Source:Companydata,DeutscheBankestimates14151617E18E19ENetdebt/equity(LHS)Netinterestcover(RHS)JohnChou+85222036196john.chou@db.comDeutscheBankAG/HongKongPage9\n4January2018ConsumerChinasportswearAppendix1ImportantDisclosures*OtherinformationavailableuponrequestDisclosurechecklistCompanyTickerRecentprice*DisclosureAnta2020.HK35.60(HKD)3Jan1814,15LiNingCoLtd2331.HK6.60(HKD)3Jan1813PouSheng3813.HK1.16(HKD)3Jan18NAPricesarecurrentasoftheendoftheprevioustradingsessionunlessotherwiseindicatedandaresourcedfromlocalexchangesviaReuters,Bloombergandothervendors.OtherinformationissourcedfromDeutscheBank,subjectcompanies,andothersources.Fordisclosurespertainingtorecommendationsorestimatesmadeonsecuritiesotherthantheprimarysubjectofthisresearch,pleaseseethemostrecentlypublishedcompanyreportorvisitourglobaldisclosurelook-uppageonourwebsiteathttp://gm.db.com/ger/disclosure/DisclosureDirectory.eqsr.Asidefromwithinthisreport,importantconflictdisclosurescanalsobefoundathttps://gm.db.com/equitiesunderthe"DisclosuresLookup"and"Legal"tabs.Investorsarestronglyencouragedtoreviewthisinformationbeforeinvesting.ImportantDisclosuresRequiredbyU.S.RegulatorsDisclosuresmarkedwithanasteriskmayalsoberequiredbyatleastonejurisdictioninadditiontotheUnitedStates.SeeImportantDisclosuresRequiredbyNon-USRegulatorsandExplanatoryNotes.14.DeutscheBankand/oritsaffiliate(s)hasreceivednon-investmentbankingrelatedcompensationfromthiscompanywithinthepastyear.15.ThiscompanyhasbeenaclientofDeutscheBankSecuritiesInc.withinthepastyear,duringwhichtimeitreceivednon-investmentbankingsecurities-relatedservices.ImportantDisclosuresRequiredbyNon-U.S.RegulatorsPleasealsorefertodisclosuresintheImportantDisclosuresRequiredbyUSRegulatorsandtheExplanatoryNotes.13.Asoftheendoftheprecedingweek,DeutscheBankand/oritsaffiliate(s)ownsonepercentormoreofaclassofcommonequitysecuritiesofthiscompany.Fordisclosurespertainingtorecommendationsorestimatesmadeonsecuritiesotherthantheprimarysubjectofthisresearch,pleaseseethemostrecentlypublishedcompanyreportorvisitourglobaldisclosurelook-uppageonourwebsiteathttp://gm.db.com/ger/disclosure/DisclosureDirectory.eqsrAnalystCertificationTheviewsexpressedinthisreportaccuratelyreflectthepersonalviewsoftheundersignedleadanalystaboutthesubjectissuersandthesecuritiesofthoseissuers.Inaddition,theundersignedleadanalysthasnotandwillnotreceiveanycompensationforprovidingaspecificrecommendationorviewinthisreport.JohnChouPage10DeutscheBankAG/HongKong\n4January2018ConsumerChinasportswearHistoricalrecommendationsandtargetprice:Anta(2020.HK)(asof1/3/2018)40.00PreviousRecommendations10StrongBuy35.00Buy9MarketPerform30.00Underperform68NotRated725.00SuspendedRating1524CurrentRecommendations20.003BuyHoldSecurityPrice15.00SellNotRated10.00SuspendedRating*NewRecommendationStructure5.00asofSeptember9,2002**AnalystisnolongeratDeutsche0.00BankJan16Apr16Jul16Oct16Jan17Apr17Jul17Oct17Date1.07/01/2016:Buy,TargetPriceChangeHKD24.00JohnChou6.20/02/2017:DowngradetoHold,TargetPriceChangeHKD26.50JohnChou2.23/02/2016:Buy,TargetPriceChangeHKD23.00JohnChou7.22/02/2017:Hold,TargetPriceChangeHKD25.00JohnChou3.28/07/2016:Buy,TargetPriceChangeHKD20.50JohnChou8.05/07/2017:UpgradetoBuy,TargetPriceChangeHKD29.50JohnChou4.29/08/2016:Buy,TargetPriceChangeHKD23.00JohnChou9.12/09/2017:Buy,TargetPriceChangeHKD35.00JohnChou5.26/09/2016:Buy,TargetPriceChangeHKD24.00JohnChou10.10/10/2017:Buy,TargetPriceChangeHKD37.00JohnChouHistoricalrecommendationsandtargetprice:LiNingCoLtd(2331.HK)(asof1/3/2018)8.00PreviousRecommendations7StrongBuy7.00Buy6MarketPerform6.00Underperform345NotRated5.00SuspendedRating2CurrentRecommendations4.001BuyHoldSecurityPrice3.00SellNotRated2.00SuspendedRating*NewRecommendationStructure1.00asofSeptember9,2002**AnalystisnolongeratDeutsche0.00BankJan16Apr16Jul16Oct16Jan17Apr17Jul17Oct17Date1.17/05/2016:UpgradetoBuy,TargetPriceChangeHKD3.80John5.23/03/2017:Buy,TargetPriceChangeHKD5.50JohnChouChou2.11/08/2016:Buy,TargetPriceChangeHKD5.00JohnChou6.05/07/2017:Buy,TargetPriceChangeHKD6.80JohnChou3.26/09/2016:Buy,TargetPriceChangeHKD6.20JohnChou7.10/10/2017:Buy,TargetPriceChangeHKD7.70JohnChou4.20/02/2017:Buy,TargetPriceChangeHKD5.90JohnChouDeutscheBankAG/HongKongPage11\n4January2018ConsumerChinasportswearHistoricalrecommendationsandtargetprice:PouSheng(3813.HK)(asof1/3/2018)3.00PreviousRecommendations1StrongBuy2.50BuyMarketPerformUnderperform3NotRated2.002SuspendedRating54CurrentRecommendations1.506BuyHoldSecurityPriceSell1.00NotRatedSuspendedRating0.50*NewRecommendationStructureasofSeptember9,2002**AnalystisnolongeratDeutsche0.00BankJan16Apr16Jul16Oct16Jan17Apr17Jul17Oct17Date1.26/09/2016:UpgradetoBuy,TargetPriceChangeHKD3.40John4.22/05/2017:Buy,TargetPriceChangeHKD2.20JohnChouChou2.12/01/2017:Buy,TargetPriceChangeHKD3.10JohnChou5.03/08/2017:Buy,TargetPriceChangeHKD2.40JohnChou3.27/03/2017:Buy,TargetPriceChangeHKD2.40JohnChou6.15/11/2017:DowngradetoHold,TargetPriceChangeHKD1.20JohnChouEquityratingkeyEquityratingdispersionandbankingrelationshipsBuy:Basedonacurrent12-monthviewoftotal600share-holderreturn(TSR=percentagechangein50057%sharepricefromcurrentpricetoprojectedtargetpricepluspro-jecteddividendyield),werecommendthat400investorsbuythestock.30033%200Sell:Basedonacurrent12-monthviewoftotalshare-17%10%10018%14%holderreturn,werecommendthatinvestorssellthe0stockBuyHoldSellHold:Wetakeaneutralviewonthestock12-monthsoutand,basedonthistimehorizon,donotCompaniesCoveredCos.w/BankingRelationshiprecommendeitheraBuyorSell.Asia-PacificUniverseNewlyissuedresearchrecommendationsandtargetpricessupersedepreviouslypublishedresearch.Page12DeutscheBankAG/HongKong\n4January2018ConsumerChinasportswearAdditionalInformationTheinformationandopinionsinthisreportwerepreparedbyDeutscheBankAGoroneofitsaffiliates(collectively"DeutscheBank").Thoughtheinformationhereinisbelievedtobereliableandhasbeenobtainedfrompublicsourcesbelievedtobereliable,DeutscheBankmakesnorepresentationastoitsaccuracyorcompleteness.Hyperlinkstothird-partywebsitesinthisreportareprovidedforreaderconvenienceonly.DeutscheBankneitherendorsesthecontentnorisresponsiblefortheaccuracyorsecuritycontrolsofthosewebsites.IfyouusetheservicesofDeutscheBankinconnectionwithapurchaseorsaleofasecuritythatisdiscussedinthisreport,orisincludedordiscussedinanothercommunication(oralorwritten)fromaDeutscheBankanalyst,DeutscheBankmayactasprincipalforitsownaccountorasagentforanotherperson.DeutscheBankmayconsiderthisreportindecidingtotradeasprincipal.Itmayalsoengageintransactions,foritsownaccountorwithcustomers,inamannerinconsistentwiththeviewstakeninthisresearchreport.OtherswithinDeutscheBank,includingstrategists,salesstaffandotheranalysts,maytakeviewsthatareinconsistentwiththosetakeninthisresearchreport.DeutscheBankissuesavarietyofresearchproducts,includingfundamentalanalysis,equity-linkedanalysis,quantitativeanalysisandtradeideas.Recommendationscontainedinonetypeofcommunicationmaydifferfromrecommendationscontainedinothers,whetherasaresultofdifferingtimehorizons,methodologies,perspectivesorotherwise.DeutscheBankand/oritsaffiliatesmayalsobeholdingdebtorequitysecuritiesoftheissuersitwriteson.AnalystsarepaidinpartbasedontheprofitabilityofDeutscheBankAGanditsaffiliates,whichincludesinvestmentbanking,tradingandprincipaltradingrevenues.Opinions,estimatesandprojectionsconstitutethecurrentjudgmentoftheauthorasofthedateofthisreport.TheydonotnecessarilyreflecttheopinionsofDeutscheBankandaresubjecttochangewithoutnotice.DeutscheBankprovidesliquidityforbuyersandsellersofsecuritiesissuedbythecompaniesitcovers.DeutscheBankresearchanalystssometimeshaveshorter-termtradeideasthatmaybeinconsistentwithDeutscheBank'sexistinglonger-termratings.TradeideasforequitiescanbefoundattheSOLARlinkathttp://gm.db.com.ASOLARidearepresentsahigh-convictionbeliefbyananalystthatastockwilloutperformorunderperformthemarketand/oraspecifiedsectoroveratimeframeofnolessthantwoweeksandnomorethansixmonths.InadditiontoSOLARideas,analystsmayoccasionallydiscusswithourclients,andwithDeutscheBanksalespersonsandtraders,tradingstrategiesorideasthatreferencecatalystsoreventsthatmayhaveanear-termormedium-termimpactonthemarketpriceofthesecuritiesdiscussedinthisreport,whichimpactmaybedirectionallycountertotheanalysts'current12-monthviewoftotalreturnorinvestmentreturnasdescribedherein.DeutscheBankhasnoobligationtoupdate,modifyoramendthisreportortootherwisenotifyarecipientthereofifanopinion,forecastorestimatechangesorbecomesinaccurate.Coverageandthefrequencyofchangesinmarketconditionsandinbothgeneralandcompany-specificeconomicprospectsmakeitdifficulttoupdateresearchatdefinedintervals.UpdatesareatthesolediscretionofthecoverageanalystoroftheResearchDepartmentManagement,andthemajorityofreportsarepublishedatirregularintervals.Thisreportisprovidedforinformationalpurposesonlyanddoesnottakeintoaccounttheparticularinvestmentobjectives,financialsituations,orneedsofindividualclients.Itisnotanofferorasolicitationofanoffertobuyorsellanyfinancialinstrumentsortoparticipateinanyparticulartradingstrategy.Targetpricesareinherentlyimpreciseandaproductoftheanalyst’sjudgment.Thefinancialinstrumentsdiscussedinthisreportmaynotbesuitableforallinvestors,andinvestorsmustmaketheirowninformedinvestmentdecisions.Pricesandavailabilityoffinancialinstrumentsaresubjecttochangewithoutnotice,andinvestmenttransactionscanleadtolossesasaresultofpricefluctuationsandotherfactors.Ifafinancialinstrumentisdenominatedinacurrencyotherthananinvestor'scurrency,achangeinexchangeratesmayadverselyaffecttheinvestment.Pastperformanceisnotnecessarilyindicativeoffutureresults.Performancecalculationsexcludetransactioncosts,unlessotherwiseindicated.Unlessotherwiseindicated,pricesarecurrentasoftheendoftheprevioustradingsessionandaresourcedfromlocalexchangesviaReuters,Bloombergandothervendors.DataisalsosourcedfromDeutscheBank,subjectcompanies,andotherparties.TheDeutscheBankResearchDepartmentisindependentofotherbusinessdivisionsoftheBank.DetailsregardingorganizationalarrangementsandinformationbarrierswehaveestablishedtopreventandavoidconflictsofinterestwithrespecttoourresearchareavailableonourwebsiteunderDisclaimer,foundontheLegaltab.DeutscheBankAG/HongKongPage13\n4January2018ConsumerChinasportswearMacroeconomicfluctuationsoftenaccountformostoftherisksassociatedwithexposurestoinstrumentsthatpromisetopayfixedorvariableinterestrates.Foraninvestorwhoislongfixed-rateinstruments(thusreceivingthesecashflows),increasesininterestratesnaturallyliftthediscountfactorsappliedtotheexpectedcashflowsandthuscausealoss.Thelongerthematurityofacertaincashflowandthehigherthemoveinthediscountfactor,thehigherwillbetheloss.Upsidesurprisesininflation,fiscalfundingneeds,andFXdepreciationratesareamongthemostcommonadversemacroeconomicshockstoreceivers.Butcounterpartyexposure,issuercreditworthiness,clientsegmentation,regulation(includingchangesinassetsholdinglimitsfordifferenttypesofinvestors),changesintaxpolicies,currencyconvertibility(whichmayconstraincurrencyconversion,repatriationofprofitsand/orliquidationofpositions),andsettlementissuesrelatedtolocalclearinghousesarealsoimportantriskfactors.Thesensitivityoffixed-incomeinstrumentstomacroeconomicshocksmaybemitigatedbyindexingthecontractedcashflowstoinflation,toFXdepreciation,ortospecifiedinterestrates–thesearecommoninemergingmarkets.Theindexfixingsmay–byconstruction–lagormis-measuretheactualmoveintheunderlyingvariablestheyareintendedtotrack.Thechoiceoftheproperfixing(ormetric)isparticularlyimportantinswapsmarkets,wherefloatingcouponrates(i.e.,couponsindexedtoatypicallyshort-datedinterestratereferenceindex)areexchangedforfixedcoupons.FundinginacurrencythatdiffersfromthecurrencyinwhichcouponsaredenominatedcarriesFXrisk.Optionsonswaps(swaptions)theriskstypicaltooptionsinadditiontotherisksrelatedtoratesmovements.Derivativetransactionsinvolvenumerousrisksincludingmarket,counterpartydefaultandilliquidityrisk.Theappropriatenessoftheseproductsforusebyinvestorsdependsontheinvestors'owncircumstances,includingtheirtaxposition,theirregulatoryenvironmentandthenatureoftheirotherassetsandliabilities;assuch,investorsshouldtakeexpertlegalandfinancialadvicebeforeenteringintoanytransactionsimilartoorinspiredbythecontentsofthispublication.Theriskoflossinfuturestradingandoptions,foreignordomestic,canbesubstantial.Asaresultofthehighdegreeofleverageobtainableinfuturesandoptionstrading,lossesmaybeincurredthataregreaterthantheamountoffundsinitiallydeposited–uptotheoreticallyunlimitedlosses.Tradinginoptionsinvolvesriskandisnotsuitableforallinvestors.Priortobuyingorsellinganoption,investorsmustreviewthe"CharacteristicsandRisksofStandardizedOptions”,athttp://www.optionsclearing.com/about/publications/character-risks.jsp.Ifyouareunabletoaccessthewebsite,pleasecontactyourDeutscheBankrepresentativeforacopyofthisimportantdocument.Participantsinforeignexchangetransactionsmayincurrisksarisingfromseveralfactors,including:(i)exchangeratescanbevolatileandaresubjecttolargefluctuations;(ii)thevalueofcurrenciesmaybeaffectedbynumerousmarketfactors,includingworldandnationaleconomic,politicalandregulatoryevents,eventsinequityanddebtmarketsandchangesininterestrates;and(iii)currenciesmaybesubjecttodevaluationorgovernment-imposedexchangecontrols,whichcouldaffectthevalueofthecurrency.InvestorsinsecuritiessuchasADRs,whosevaluesareaffectedbythecurrencyofanunderlyingsecurity,effectivelyassumecurrencyrisk.DeutscheBankisnotactingasafinancialadviser,consultantorfiduciarytoyouoranyofyouragentswithrespecttoanyinformationprovidedinthisreport.DeutscheBankdoesnotprovideinvestment,legal,taxoraccountingadvice,andisnotactingasanimpartialadviser.Informationcontainedhereinisbeingprovidedonthebasisthattherecipientwillmakeanindependentassessmentofthemeritsofanyinvestmentdecision,andisnotmeantforretirementaccountsorforanyspecificpersonoraccounttype.Theinformationweprovideisdirectedonlytopersonswebelievetobefinanciallysophisticated,whoarecapableofevaluatinginvestmentrisksindependently,bothingeneralandwithregardtoparticulartransactionsandinvestmentstrategies,andwhounderstandthatDeutscheBankhasfinancialinterestsintheofferingofitsproductsandservices.Ifthisisnotthecase,orifyouoryouragentareanIRAorotherretailinvestorreceivingthisdirectlyfromus,weaskthatyouinformusimmediately.Unlessgoverninglawprovidesotherwise,alltransactionsshouldbeexecutedthroughtheDeutscheBankentityintheinvestor'shomejurisdiction.Asidefromwithinthisreport,importantriskandconflictdisclosurescanalsobefoundathttps://gm.db.comoneachcompany’sresearchpageandunderthe"DisclosuresLookup"and"Legal"tabs.Investorsarestronglyencouragedtoreviewthisinformationbeforeinvesting.UnitedStates:Approvedand/ordistributedbyDeutscheBankSecuritiesIncorporated,amemberofFINRA,NFAandSIPC.AnalystslocatedoutsideoftheUnitedStatesareemployedbynon-USaffiliatesthatarenotsubjecttoFINRAregulations,includingthoseregardingcontactswithissuercompanies.Germany:Approvedand/ordistributedbyDeutscheBankAG,ajointstockcorporationwithlimitedliabilityincorporatedintheFederalRepublicofGermanywithitsprincipalofficeinFrankfurtamMain.DeutscheBankAGisauthorizedunderPage14DeutscheBankAG/HongKong\n4January2018ConsumerChinasportswearGermanBankingLawandissubjecttosupervisionbytheEuropeanCentralBankandbyBaFin,Germany’sFederalFinancialSupervisoryAuthority.UnitedKingdom:Approvedand/ordistributedbyDeutscheBankAGactingthroughitsLondonBranchatWinchesterHouse,1GreatWinchesterStreet,LondonEC2N2DB.DeutscheBankAGintheUnitedKingdomisauthorisedbythePrudentialRegulationAuthorityandissubjecttolimitedregulationbythePrudentialRegulationAuthorityandFinancialConductAuthority.Detailsabouttheextentofourauthorisationandregulationareavailableonrequest.HongKong:DistributedbyDeutscheBankAG,HongKongBranchorDeutscheSecuritiesAsiaLimited(savethatanyresearchrelatingtofuturescontractswithinthemeaningoftheHongKongSecuritiesandFuturesOrdinanceCap.571shallbedistributedsolelybyDeutscheSecuritiesAsiaLimited).Theprovisionssetoutaboveinthe"AdditionalInformation"sectionshallapplytothefullestextentpermissiblebylocallawsandregulations,includingwithoutlimitationtheCodeofConductforPersonsLicensedorRegisteredwiththeSecuritiesandFuturesCommission..India:PreparedbyDeutscheEquitiesIndiaPrivateLimited(DEIPL)havingCIN:U65990MH2002PTC137431andregisteredofficeat14thFloor,TheCapital,C-70,GBlock,BandraKurlaComplexMumbai(India)400051.Tel:+912271804444.ItisregisteredbytheSecuritiesandExchangeBoardofIndia(SEBI)asaStockbrokerbearingregistrationnos.:NSE(CapitalMarketSegment)-INB231196834,NSE(F&OSegment)INF231196834,NSE(CurrencyDerivativesSegment)INE231196834,BSE(CapitalMarketSegment)INB011196830;MerchantBankerbearingSEBIRegistrationno.:INM000010833andResearchAnalystbearingSEBIRegistrationno.:INH000001741.DEIPLmayhavereceivedadministrativewarningsfromtheSEBIforbreachesofIndianregulations.DeutscheBankand/oritsaffiliate(s)mayhavedebtholdingsorpositionsinthesubjectcompany.Withregardtoinformationonassociates,pleaserefertothe“Shareholdings”sectionintheAnnualReportat:https://www.db.com/ir/en/annual-reports.htm.Japan:Approvedand/ordistributedbyDeutscheSecuritiesInc.(DSI).Registrationnumber-RegisteredasafinancialinstrumentsdealerbytheHeadoftheKantoLocalFinanceBureau(Kinsho)No.117.Memberofassociations:JSDA,TypeIIFinancialInstrumentsFirmsAssociationandTheFinancialFuturesAssociationofJapan.Commissionsandrisksinvolvedinstocktransactions-forstocktransactions,wechargestockcommissionsandconsumptiontaxbymultiplyingthetransactionamountbythecommissionrateagreedwitheachcustomer.Stocktransactionscanleadtolossesasaresultofsharepricefluctuationsandotherfactors.Transactionsinforeignstockscanleadtoadditionallossesstemmingfromforeignexchangefluctuations.Wemayalsochargecommissionsandfeesforcertaincategoriesofinvestmentadvice,productsandservices.Recommendedinvestmentstrategies,productsandservicescarrytheriskoflossestoprincipalandotherlossesasaresultofchangesinmarketand/oreconomictrends,and/orfluctuationsinmarketvalue.Beforedecidingonthepurchaseoffinancialproductsand/orservices,customersshouldcarefullyreadtherelevantdisclosures,prospectusesandotherdocumentation."Moody's","Standard&Poor's",and"Fitch"mentionedinthisreportarenotregisteredcreditratingagenciesinJapanunlessJapanor"Nippon"isspecificallydesignatedinthenameoftheentity.ReportsonJapaneselistedcompaniesnotwrittenbyanalystsofDSIarewrittenbyDeutscheBankGroup'sanalystswiththecoveragecompaniesspecifiedbyDSI.SomeoftheforeignsecuritiesstatedonthisreportarenotdisclosedaccordingtotheFinancialInstrumentsandExchangeLawofJapan.TargetpricessetbyDeutscheBank'sequityanalystsarebasedona12-monthforecastperiod..Korea:DistributedbyDeutscheSecuritiesKoreaCo.SouthAfrica:DeutscheBankAGJohannesburgisincorporatedintheFederalRepublicofGermany(BranchRegisterNumberinSouthAfrica:1998/003298/10).Singapore:ThisreportisissuedbyDeutscheBankAG,SingaporeBranchorDeutscheSecuritiesAsiaLimited,SingaporeBranch(OneRafflesQuay#18-00SouthTowerSingapore048583,+6564238001),whichmaybecontactedinrespectofanymattersarisingfrom,orinconnectionwith,thisreport.WherethisreportisissuedorpromulgatedbyDeutscheBankinSingaporetoapersonwhoisnotanaccreditedinvestor,expertinvestororinstitutionalinvestor(asdefinedintheapplicableSingaporelawsandregulations),theyacceptlegalresponsibilitytosuchpersonforitscontents.Taiwan:Informationonsecurities/investmentsthattradeinTaiwanisforyourreferenceonly.Readersshouldindependentlyevaluateinvestmentrisksandaresolelyresponsiblefortheirinvestmentdecisions.DeutscheBankresearchmaynotbedistributedtotheTaiwanpublicmediaorquotedorusedbytheTaiwanpublicmediawithoutDeutscheBankAG/HongKongPage15\n4January2018ConsumerChinasportswearwrittenconsent.Informationonsecurities/instrumentsthatdonottradeinTaiwanisforinformationalpurposesonlyandisnottobeconstruedasarecommendationtotradeinsuchsecurities/instruments.DeutscheSecuritiesAsiaLimited,TaipeiBranchmaynotexecutetransactionsforclientsinthesesecurities/instruments.Qatar:DeutscheBankAGintheQatarFinancialCentre(registeredno.00032)isregulatedbytheQatarFinancialCentreRegulatoryAuthority.DeutscheBankAG-QFCBranchmayundertakeonlythefinancialservicesactivitiesthatfallwithinthescopeofitsexistingQFCRAlicense.ItsprincipalplaceofbusinessintheQFC:QatarFinancialCentre,Tower,WestBay,Level5,POBox14928,Doha,Qatar.ThisinformationhasbeendistributedbyDeutscheBankAG.RelatedfinancialproductsorservicesareonlyavailableonlytoBusinessCustomers,asdefinedbytheQatarFinancialCentreRegulatoryAuthority.Russia:Theinformation,interpretationandopinionssubmittedhereinarenotinthecontextof,anddonotconstitute,anyappraisalorevaluationactivityrequiringalicenseintheRussianFederation.KingdomofSaudiArabia:DeutscheSecuritiesSaudiArabiaLLCCompany(registeredno.07073-37)isregulatedbytheCapitalMarketAuthority.DeutscheSecuritiesSaudiArabiamayundertakeonlythefinancialservicesactivitiesthatfallwithinthescopeofitsexistingCMAlicense.ItsprincipalplaceofbusinessinSaudiArabia:KingFahadRoad,AlOlayaDistrict,P.O.Box301809,FaisaliahTower-17thFloor,11372Riyadh,SaudiArabia.UnitedArabEmirates:DeutscheBankAGintheDubaiInternationalFinancialCentre(registeredno.00045)isregulatedbytheDubaiFinancialServicesAuthority.DeutscheBankAG-DIFCBranchmayundertakeonlythefinancialservicesactivitiesthatfallwithinthescopeofitsexistingDFSAlicense.ItsprincipalplaceofbusinessintheDIFC:DubaiInternationalFinancialCentre,TheGateVillage,Building5,POBox504902,Dubai,U.A.E.ThisinformationhasbeendistributedbyDeutscheBankAG.RelatedfinancialproductsorservicesareavailableonlytoProfessionalClients,asdefinedbytheDubaiFinancialServicesAuthority.AustraliaandNewZealand:Thisresearchisintendedonlyfor"wholesaleclients"withinthemeaningoftheAustralianCorporationsActandNewZealandFinancialAdvisorsAct,respectively.PleaserefertoAustralia-specificresearchdisclosuresandrelatedinformationathttps://australia.db.com/australia/content/research-information.htmlWhereresearchreferstoanyparticularfinancialproductrecipientsoftheresearchshouldconsideranyproductdisclosurestatement,prospectusorotherapplicabledisclosuredocumentbeforemakinganydecisionaboutwhethertoacquiretheproduct.Additionalinformationrelativetosecurities,otherfinancialproductsorissuersdiscussedinthisreportisavailableuponrequest.Thisreportmaynotbereproduced,distributedorpublishedwithoutDeutscheBank'spriorwrittenconsent.Copyright©2018DeutscheBankAGPage16DeutscheBankAG/HongKong\nDavidFolkerts-LandauGroupChiefEconomistandGlobalHeadofResearchRajHindochaMichaelSpencerStevePollardGlobalChiefOperatingOfficerHeadofAPACResearchHeadofAmericasResearchResearchGlobalHeadofEconomicsGlobalHeadofEquityResearchAnthonyKlarmanPaulReynoldsDaveClarkPamFinelliGlobalHeadofHeadofEMEAHeadofAPACGlobalHeadofDebtResearchEquityResearchEquityResearchEquityDerivativesResearchAndreasNeubauerSpyrosMesomerisHeadofResearch-GermanyGlobalHeadofQuantitativeandQISResearchInternationallocationsDeutscheBankAGDeutscheBankAGDeutscheBankAGDeutscheSecuritiesInc.DeutscheBankPlaceMainzerLandstrasse11-17FilialeHongkong2-11-1NagatachoLevel1660329FrankfurtamMainInternationalCommerceCentre,SannoParkTowerCornerofHunter&PhillipStreetsGermany1AustinRoadWest,Kowloon,Chiyoda-ku,Tokyo100-6171Sydney,NSW2000Tel:(49)6991000HongKongJapanAustraliaTel:(852)22038888Tel:(81)351566770Tel:(61)282581234DeutscheBankAGLondonDeutscheBankSecuritiesInc.1GreatWinchesterStreet60WallStreetLondonEC2N2EQNewYork,NY10005UnitedKingdomUnitedStatesofAmericaTel:(44)2075458000Tel:(1)2122502500